Procter & Gamble Ends Week on a High Note, Setting Stage for Monday

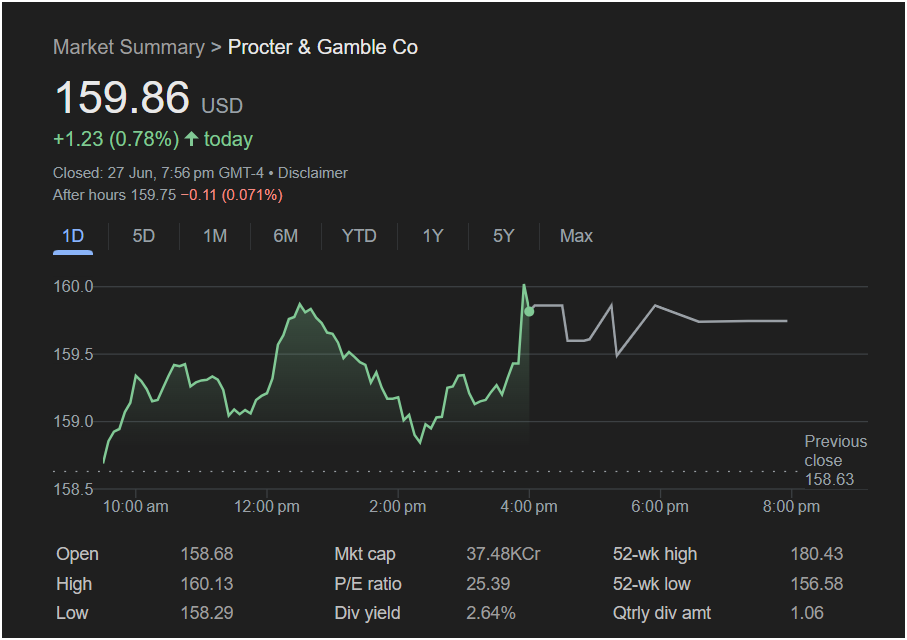

CINCINNATI – Shares of consumer goods titan Procter & Gamble Co. (NYSE: PG) finished Thursday’s trading session on a strong footing, closing at

1.23 (0.78%) for the day. The stock demonstrated significant upward momentum into the close, briefly touching above the key $160 mark.

The session was a positive one for the blue-chip stalwart. After opening at $158.68, the stock navigated a dip to a low of

160.13**. This strong finish, well above the previous day’s close of $158.63, suggests robust buying interest as the week concluded.

In a minor note of caution, after-hours trading saw a marginal pullback. The stock shed

159.75. This slight dip is minimal but indicates the psychological resistance at the $160 level may be a factor in the near term.

Will the Market Go Up or Down on Monday?

The Bullish Case (Market Up): The outlook heading into Monday appears cautiously optimistic. The primary driver is the powerful momentum seen at the end of Thursday’s session. Breaking through the $160 barrier, even temporarily, is a psychologically significant event for traders. P&G’s status as a defensive stock with a healthy dividend yield (2.64%) makes it an attractive holding in uncertain markets. If this positive sentiment carries through the weekend, the stock could make a more sustained attempt to hold above $160.

The Bearish Case (Market Down): The slight fade in after-hours trading and the inability to close above 158.60** level (the previous close and Thursday’s open)

The evidence leans slightly positive for Procter & Gamble on Monday. The strength and volume of the late-day rally are difficult to ignore and typically signal continued buying interest. However, the key test will be whether the stock can decisively break and hold above the $160.13 high.

Investors should watch the pre-market activity closely. A move above this level would be a strong bullish signal. Conversely, a drop below $159.50 at the open could indicate that Thursday’s rally is losing steam, potentially leading to a sideways or downward trading day.