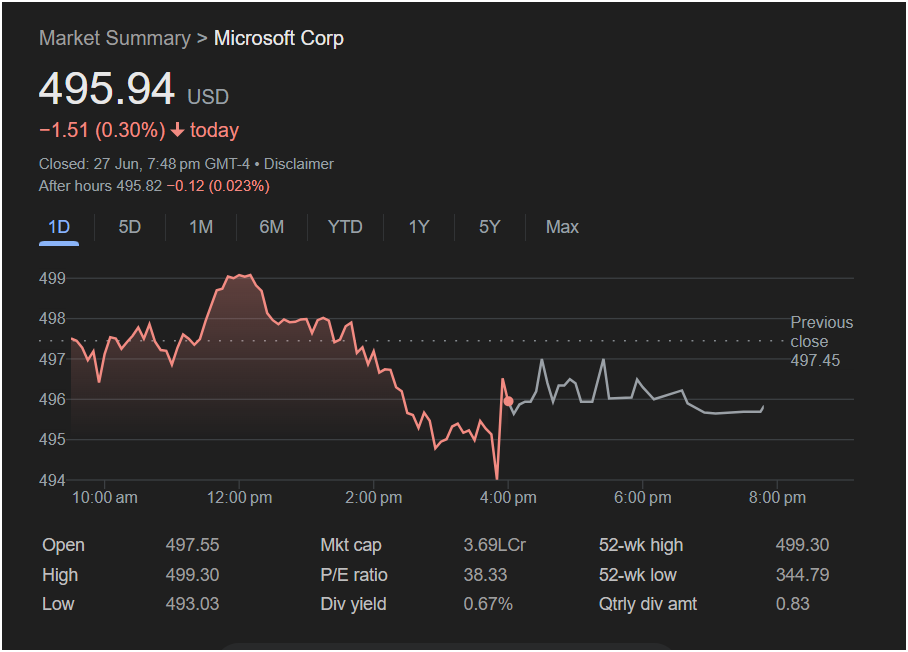

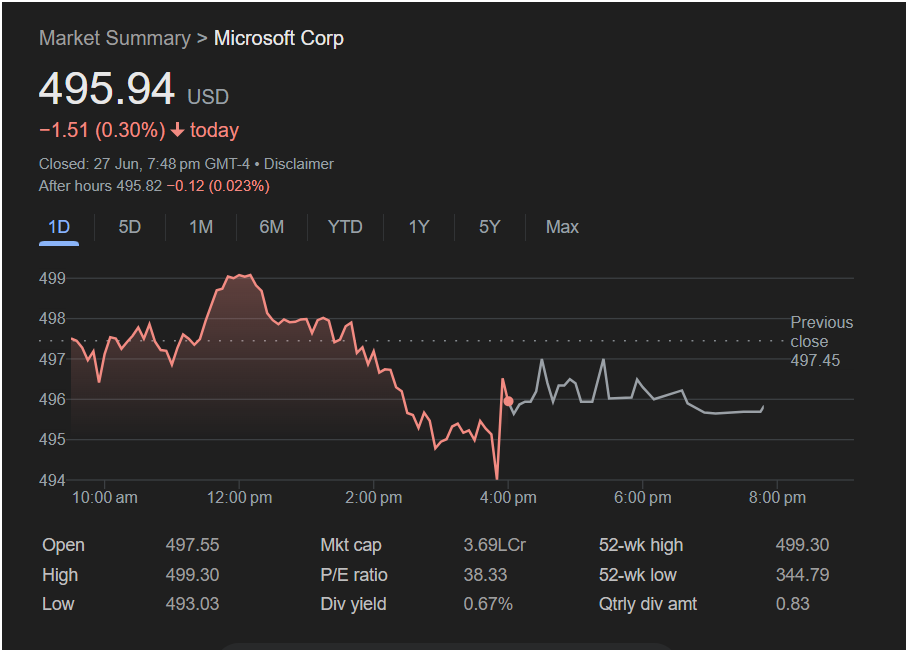

Microsoft Falters After Touching New 52-Week High, Signaling Potential Weakness

NEW YORK – Microsoft Corp (MSFT) shares experienced a volatile trading day, ultimately closing in the red despite hitting a new 52-week high, suggesting that seller sentiment may carry into the new trading week. The tech giant finished the session at

1.51 (0.30%).

The day’s trading tells a story of a failed breakout attempt. After opening at

499.30**. However, this peak proved to be a strong resistance point. Sellers stepped in aggressively, reversing the gains and driving the stock down for the remainder of the session to a low of $493.03.

While the stock found some footing in the final hour of trading, it failed to recover its earlier losses. A slight dip in after-hours trading to $495.82 further solidified the bearish sentiment heading into the weekend.

Outlook for Monday:

The intraday reversal from a 52-week high is a significant technical signal that points toward a cautious to bearish outlook for Monday’s session.

-

Rejection at Resistance: The failure to hold gains above the $499.30 level indicates that bulls may be exhausted. This price point now stands as a formidable resistance level that buyers will need to overcome to regain momentum.

-

Key Support to Watch: The daily low of $493.03 will be a critical support level at the start of next week. A break below this level could signal that the downward trend is accelerating, potentially leading to further losses.

-

Intraday Weakness: Closing well below the day’s high indicates that sellers were in control by the end of the session.

Investors on Monday will be watching to see if buyers can defend the $493 support level or if the selling pressure from Friday’s peak continues, potentially pushing the stock lower to find its next base of support.