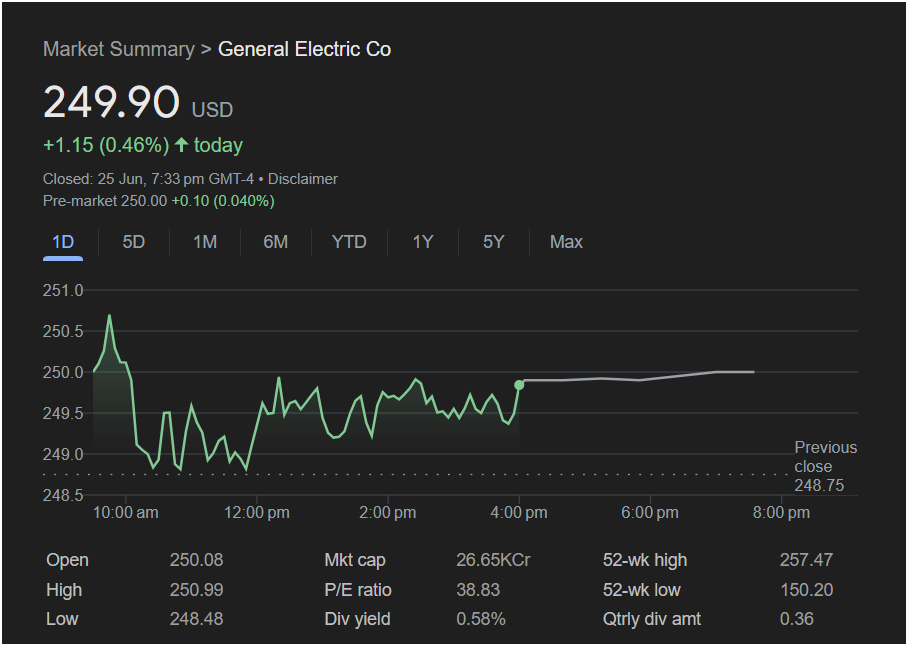

General Electric Stock Shows Resilience, Rebounds Sharply From Intraday Lows

BOSTON – General Electric Co (GE) stock navigated a highly volatile trading session on Tuesday, ultimately closing in the green after a significant intraday recovery. The day’s price action reveals key support and resistance levels that will be critical for traders to watch in the upcoming session.

The industrial conglomerate’s stock closed the session on Tuesday, June 25th, at

1.15 (0.46%). This positive close came after a dramatic swing, demonstrating the stock’s resilience. Pre-market trading indicates a stable to slightly positive start for the next day, with the stock at

0.10 (0.040%).

A Day of Rejection and Recovery

The intraday chart for General Electric stock highlights a classic battle between bulls and bears. The stock opened at

250.99**. However, this early strength was met with significant selling pressure, which drove the stock down more than

248.48**.

What happened next is crucial for traders: buyers stepped in aggressively at this low point. The stock then spent the rest of the day grinding higher, erasing its losses and closing near the psychologically important

249 level.

Key Data for Your Analysis

Traders should keep these vital statistics in mind when planning their next move:

-

Closing Price: $249.90

-

Day’s Change: +$1.15 (+0.46%)

-

Pre-Market (Next Day): $250.00 (+0.040%)

-

Day’s Range: $248.48 (Low) to $250.99 (High)

-

Previous Close: $248.75

-

52-Week High: $257.47

-

52-Week Low: $150.20

-

P/E Ratio: 38.83

Market Outlook: Will GE Stock Go Up or Down?

The technical signals from the trading session are mixed, but the strong recovery provides a slight bullish edge.

Bullish Indicators:

-

Strong Rebound: The recovery from the low of $248.48 is the most significant bullish signal. It establishes this level as a key area of short-term support.

-

Positive Close: Despite the volatility, the stock managed to close well above the previous day’s close and its own session low.

-

Holding $250: The stock is hovering right around the $250 level, and a firm move above it could trigger further buying.

Bearish Indicators:

-

Rejection at the High: The sharp sell-off from the morning high of $250.99 shows that there is a supply of shares (resistance) at that level.

The outlook suggests that GE stock is currently in a consolidation phase. The key battleground will be between the support at

250.99.

Is It the Right Time to Invest Today?

For investors considering a position in GE, the recent price action offers clear entry and exit points.

-

For Short-Term Traders: The recovery provides a potential buying opportunity. An entry near the current price with a stop-loss set just below the day’s low of $248.48 could be a viable strategy. The primary target would be a break above the day’s high of $250.99.

-

For Conservative Investors: It may be prudent to wait for more confirmation. A decisive and sustained close above $251 would signal that the bulls have overcome the recent resistance and could be a safer entry point for a continued move towards the 52-week high.

In summary, General Electric stock showed impressive underlying strength. While some overhead resistance remains, the strong defense of the day’s lows suggests that buyers are ready to step in on dips. Watch the key levels of $248.50 and $251 closely in the next trading session.

Disclaimer: This article is for informational purposes only and is based on the analysis of the provided image. It does not constitute financial advice. Stock market trading involves risk, and investors should conduct their own thorough research and consult with a qualified financial advisor before making any investment decisions.