Amazon Stock on the Rise: What Traders Need to Know for Today’s Session

Amazon stock (NASDAQ: AMZN) is signaling a potentially strong start for the upcoming trading day, building on significant gains from the previous session. An analysis of its recent performance and pre-market activity shows bullish momentum, but traders should be aware of key levels and metrics before making any investment decisions. This article breaks down all the critical information from the latest data.

Last Session’s Strong Performance

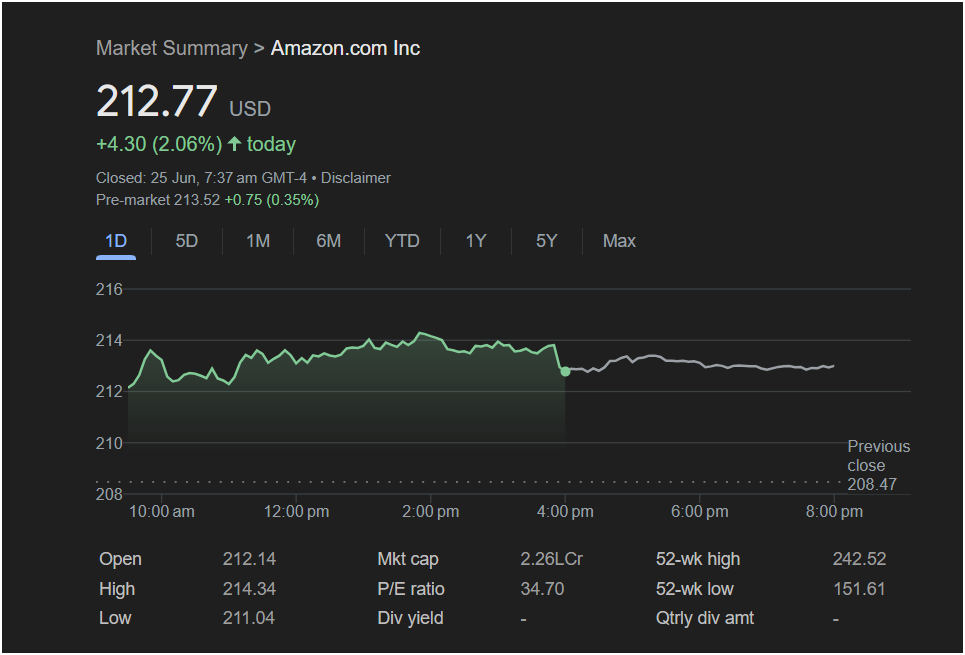

According to the market summary, Amazon Inc. closed the last trading session at

4.30, a 2.06% increase for the day. This positive performance is a key indicator of strong buying interest in the stock.

The intraday chart reveals a compelling story for traders:

-

The stock opened at $212.14.

-

It experienced a daily low of $211.04 before buyers stepped in.

-

Momentum carried it to a daily high of $214.34.

-

Crucially, it closed near the top of its daily range, suggesting that the bulls were in control at the end of the day.

This performance is even more impressive when compared to the previous day’s close of $208.47, confirming a solid upward trend in the short term.

Pre-Market Activity Points to a Higher Open

Looking ahead to today’s market open, the pre-market data provides a vital clue. As of the last update, Amazon stock was trading at

0.75 (0.35%) from its closing price.

Positive pre-market activity like this often indicates that the positive sentiment from the previous day is carrying over. It suggests that Amazon stock is likely to open higher, potentially challenging its recent high of $214.34 early in the session.

Key Financial Metrics for Your Watchlist

For any trader considering a position in Amazon, here are the essential metrics provided:

-

52-Week Range: The stock has traded between

242.52 (high) over the past year. At its current price of ~$213, it is trading in the upper half of this range but still has significant room before reaching its 52-week high, which could be seen as a potential price target.

-

Market Cap: A colossal $2.26 Trillion (2.26L Cr), reaffirming its position as a mega-cap market leader whose performance can influence the broader market.

-

P/E Ratio: The Price-to-Earnings ratio stands at 34.70. While this may seem high to value investors, it is a relatively common valuation for a high-growth technology giant like Amazon.

-

Dividend: Amazon does not currently offer a dividend (Div yield is “-“). This means investors are focused purely on capital appreciation and growth rather than income.

Outlook: Will the Stock Go Up or Down? Is It Right to Invest?

Based purely on the technical data presented, the indicators are bullish. The combination of a strong closing rally and positive pre-market momentum suggests that Amazon stock is positioned for potential gains in today’s session. Traders might watch for the stock to break above the recent high of $214.34 as a sign of continued strength.

However, making an investment decision requires a broader view. While the short-term trend is positive, market sentiment can change quickly due to macroeconomic news, industry-specific developments, or overall market volatility.

For the Trader:

-

Bullish Case: The momentum is clearly positive. A trader looking for a short-term play might see the pre-market strength as an entry signal.

-

Cautious Case: The stock is closer to its 52-week high than its low. Prudent traders might wait to see if the stock can establish solid support above its open before committing, or set stop-losses below the previous day’s low of $211.04 to manage risk.

In conclusion, while the data points to a favorable upward trend for Amazon stock today, traders should always conduct their own research, consider their risk tolerance, and stay informed on wider market news before investing.

Disclaimer: This article is for informational purposes only and is based on the data from the provided screenshot. It does not constitute financial advice. All investment decisions should be made with the help of a qualified financial professional.