Applied Materials Stock Finds Footing After Steep Plunge: What Investors Should Watch Next

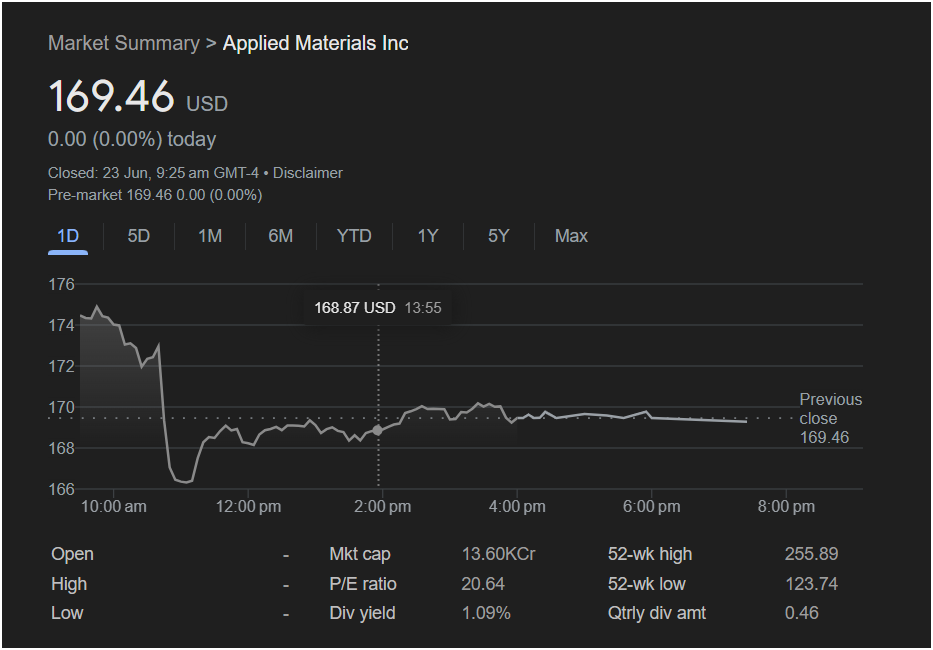

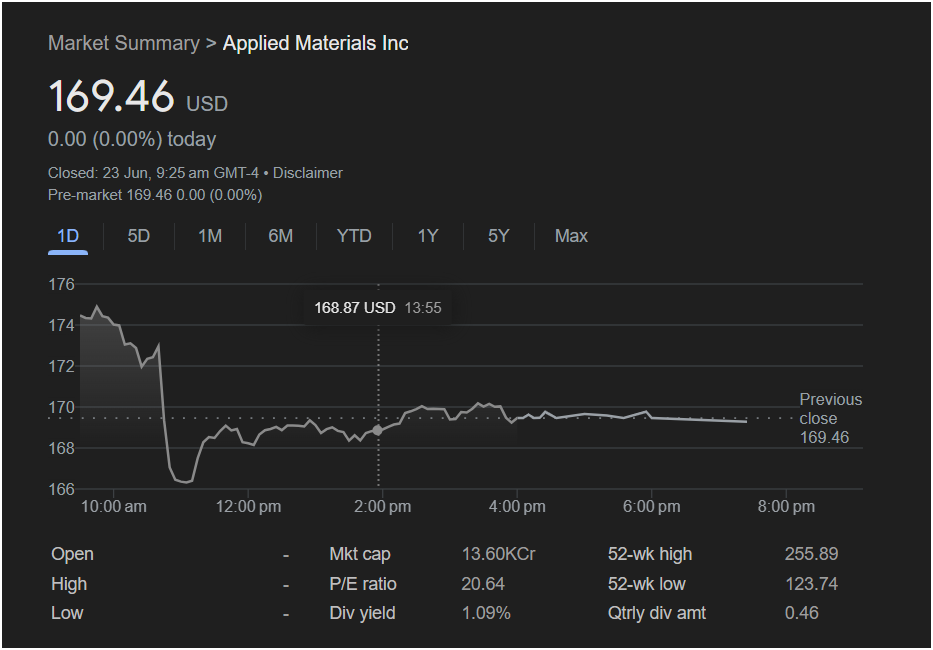

SANTA CLARA, CA – Applied Materials, Inc. (NASDAQ: AMAT) stock closed a turbulent trading session at $169.46, ending precisely where it had closed the previous day. While the 0.00% change suggests a day of calm, the intraday chart reveals a dramatic story of a sharp sell-off and subsequent stabilization, leaving investors questioning the stock’s next move.

The pre-market data on Sunday, June 23rd, shows the stock flat, awaiting the market open on Monday. Traders and investors are now closely analyzing the previous session’s chaotic price action and the company’s core metrics to determine if the stock has found a bottom or is merely pausing before another move.

A Day of Extreme Volatility

The 1-day chart for AMAT is a textbook example of volatility. The stock started the day on a high note, trading near the $175 level, before a wave of intense selling pressure hit the market. In a sharp downward move, the stock plummeted to an intraday low of approximately $166.

However, buyers stepped in at this level, halting the decline and sparking a recovery. For the remainder of the session, Applied Materials stock consolidated in a tight range, eventually closing at $169.46. This W-shaped pattern indicates that while there was an initial panic, the stock found strong support, leading to a period of equilibrium between buyers and sellers.

Analyzing Key Financials

A look at the fundamental data provides critical context for the stock’s recent performance:

-

Market Capitalization: At 13.60KCr (approximately $136 Billion), Applied Materials is a cornerstone of the global semiconductor equipment industry.

-

P/E Ratio: The stock’s Price-to-Earnings ratio is 20.64. This is a relatively moderate valuation for a leading technology company, which could attract investors looking for growth without an exorbitant price tag.

-

Dividend Yield: AMAT offers a dividend yield of 1.09%, with a quarterly payment of $0.46 per share. While not a high-yield stock, it provides a small return to shareholders.

-

52-Week Range: The stock’s 52-week high is

123.74. The current price of $169.46 is significantly below its recent peak, indicating the stock has undergone a substantial correction.

Will the Market Go Up or Down on Monday?

The technical picture presents compelling arguments for both bulls and bears:

-

The Bullish Scenario: The strong defense of the $166 support level is a positive sign. It suggests that buyers view this price as attractive. Combined with a reasonable P/E ratio, the stock could be poised for a rebound, especially if sentiment in the broader semiconductor sector improves. A sustained move above $170 could confirm this upward momentum.

-

The Bearish Scenario: The stock is clearly in a short-term downtrend, having fallen sharply from its 52-week high. The inability to recover more of the initial losses from the session shows that sellers remain active. If the stock breaks below the critical $166 support level, it could trigger another leg of the sell-off.

Is It Right to Invest Today?

The decision to invest in Applied Materials stock right now depends on an investor’s strategy.

-

For long-term investors who believe in the secular growth of the semiconductor industry, this significant pullback from the highs coupled with a moderate valuation could represent a strategic entry point.

-

For short-term traders, the key is to watch the well-defined support and resistance levels. The consolidation provides clear lines in the sand. A trade could be initiated on a decisive break above the ~

166 support.

In conclusion, Applied Materials stock is currently at a critical inflection point. The fierce intraday battle has ended in a stalemate, but the pressure is building. The market’s direction on Monday will likely depend on whether the newly established support at $166 can hold against any further selling pressure.

Disclaimer: This article is for informational purposes only and is based on the analysis of the provided image. It does not constitute financial advice. All investors should conduct their own research and consult with a qualified financial advisor before making any investment decisions.