Johnson & Johnson Stock Hits Stalemate: What’s Next for JNJ on Monday

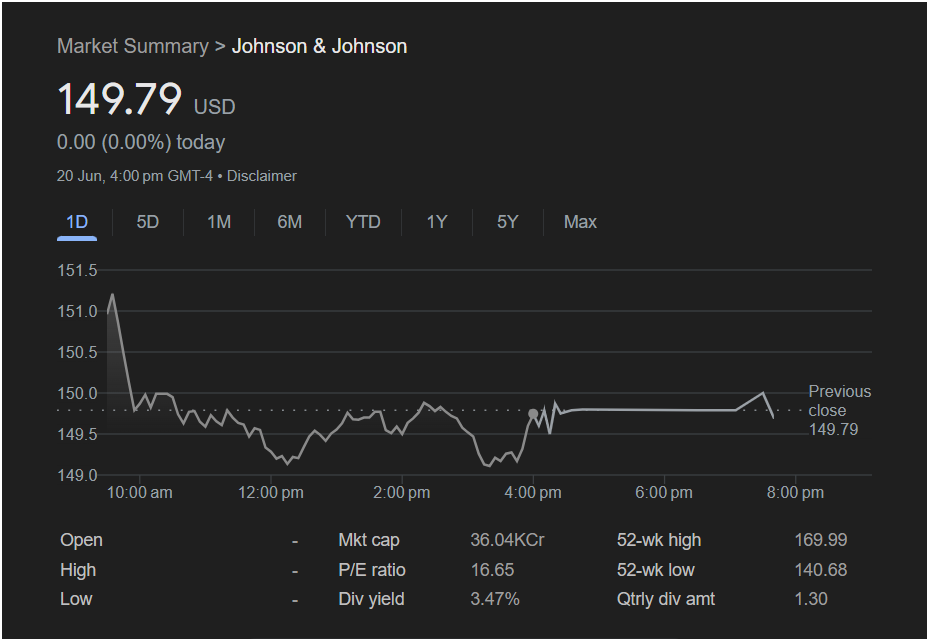

Johnson & Johnson stock (NYSE: JNJ) ended Thursday’s trading session in a rare state of perfect equilibrium, leaving investors and traders to ponder its next move ahead of the market open on Monday. The healthcare giant closed at

0.00 (0.00%), a figure that belies the intraday volatility and points to a significant tug-of-war between bullish and bearish forces.

This article breaks down the key data from Thursday’s session to provide an outlook on whether JNJ is poised to rise or fall.

Thursday’s Trading Session: A Story of Indecision

While the closing number suggests a quiet day, the intraday chart for Johnson & Johnson reveals a different story. The stock opened high, touching levels above $151.00, but was immediately met with strong selling pressure that pushed it down below the $150.00 mark.

For the remainder of the day, JNJ traded in a tight, choppy range, bottoming out near

149.79) indicates that while sellers were active, buyers stepped in to defend the sub-$150 price level, resulting in a stalemate.

Key Metrics for the Savvy Investor

A deeper look at the financials provides critical context for what might happen next:

-

P/E Ratio: 16.65 – This is a notably reasonable Price-to-Earnings ratio. Compared to many other large-cap companies, a P/E of 16.65 suggests that Johnson & Johnson stock is not overvalued and may be fairly priced, or even undervalued, based on its earnings.

-

Dividend Yield: 3.47% – With a quarterly dividend of $1.30 per share, JNJ offers a strong dividend yield of 3.47%. This is a highly attractive feature for income-focused and long-term investors, often creating a stable floor of support for the stock price.

-

52-Week Range: $140.68 – $169.99 – The current price of $149.79 sits in the lower end of its 52-week range. This positioning makes it intriguing, as it could signal a value opportunity for buyers or indicate persistent weakness that has kept the stock from reaching its prior highs.

-

Market Cap: 36.04KCr – As a blue-chip company with a massive market capitalization (approximately $360.4 billion), Johnson & Johnson is a foundational holding in many portfolios, which typically lends it more stability than smaller companies.

Analysis for Monday: The Bull vs. The Bear

The flat close creates a compelling setup for Monday. Here are the two opposing cases for JNJ stock:

The Bullish Case (Why it might go UP):

The primary argument for an upside is value. A low P/E ratio combined with a high dividend yield makes JNJ a classic value play. Investors looking for safety and income may see the current price, which is near the bottom of its yearly range, as an excellent entry point. The fact that buyers defended the price and prevented a negative close on Thursday reinforces this support.

The Bearish Case (Why it might go DOWN):

The significant sell-off after the market opened on Thursday cannot be ignored. It shows that there are determined sellers looking to push the price lower. The stock’s inability to mount a stronger recovery during the day suggests a lack of powerful buying momentum. If broader market sentiment is negative on Monday, JNJ could easily break below its recent support levels.

: Is Now the Time to Invest in JNJ?

Johnson & Johnson stock is at a critical juncture. The decision to invest today hinges on your investment strategy.

-

For the long-term value and income investor: The combination of a low P/E ratio and a robust 3.47% dividend yield makes JNJ look attractive at these levels. The recent price action could represent a solid opportunity to buy into a high-quality company at a reasonable price.

-

For the short-term trader: The indecisive close is a signal for caution. A smart approach would be to wait for confirmation on Monday. A move above the $150 psychological level could signal a bullish breakout, while a drop below Thursday’s low could mean the bears have won the battle for now.

Ultimately, Thursday’s stalemate means JNJ is coiled for a move. The direction it takes on Monday could set the tone for the coming week.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investors should conduct their own research and consider their financial circumstances before making any investment decisions.