Berkshire Hathaway Surges at Closing Bell, Setting Bullish Tone for Monday

OMAHA, NE – Warren Buffett’s Berkshire Hathaway Inc. (NYSE: BRK.A) finished Thursday’s session with a flourish, closing on a dramatic upswing that has set a decidedly positive tone for the start of next week’s trading.

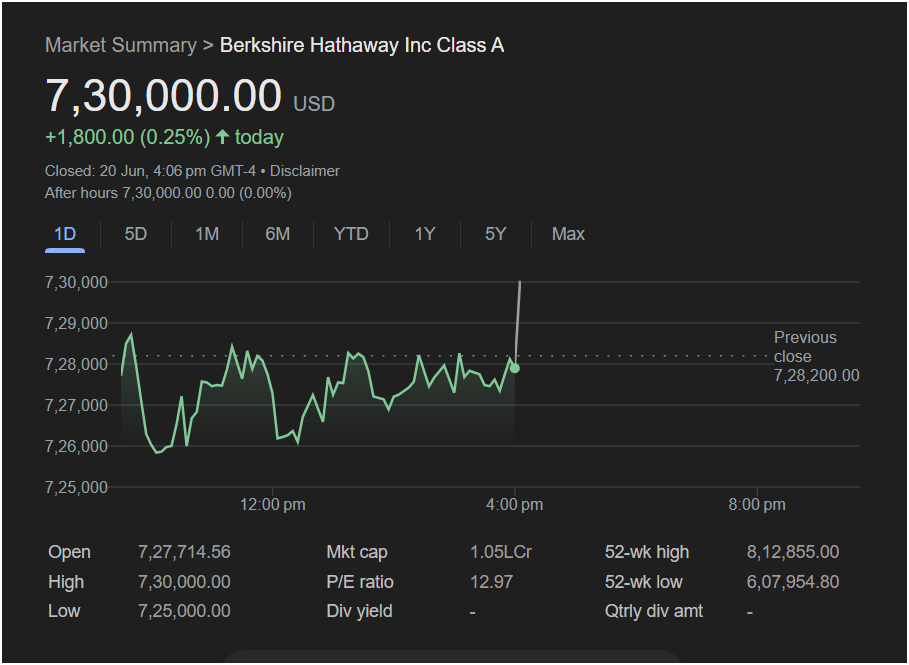

Shares of the conglomerate closed at precisely

1,800.00 (0.25%) for the day. While the overall gain appears modest, the story is in how the stock finished. After spending nearly the entire day in a tight, choppy range between roughly $725,000 and $728,500, the stock experienced an explosive spike in the final moments of trading, rocketing higher to close at the absolute peak of the session.

This last-minute buying frenzy completely changed the narrative of the day, transforming a lackluster session into a powerful statement of bullish intent.

What This Means for Monday

The extraordinary price action at the close strongly suggests the market is poised to go UP on Monday. Here’s the breakdown of the bullish signals:

-

Closing at the Absolute High: This is one of the most powerful bullish signals in technical analysis. It indicates that as the final bell rang, buyers were in complete control, and there was zero selling pressure to push the price down from its peak. This momentum very often carries over into the next session.

-

Explosive Breakout: The stock was consolidating sideways for hours, building energy. The sharp vertical move at the close represents a decisive breakout from that trading range, suggesting the period of indecision is over and bulls have taken charge.

-

Psychological Strength: The powerful finish shows aggressive buying interest. This could be indicative of a large institutional order being filled at the end of the day. Such a move signals strong conviction from major investors and can attract further buying on Monday.

Investors will be watching with keen interest to see if Berkshire Hathaway can hold this $730,000 level at the open and use it as a springboard for further gains. Based on Thursday’s stunning conclusion, the odds are firmly in the bulls’ favor.