Berkshire Stock Explodes at Close to Hit $730,000: Is a Breakout Coming Monday

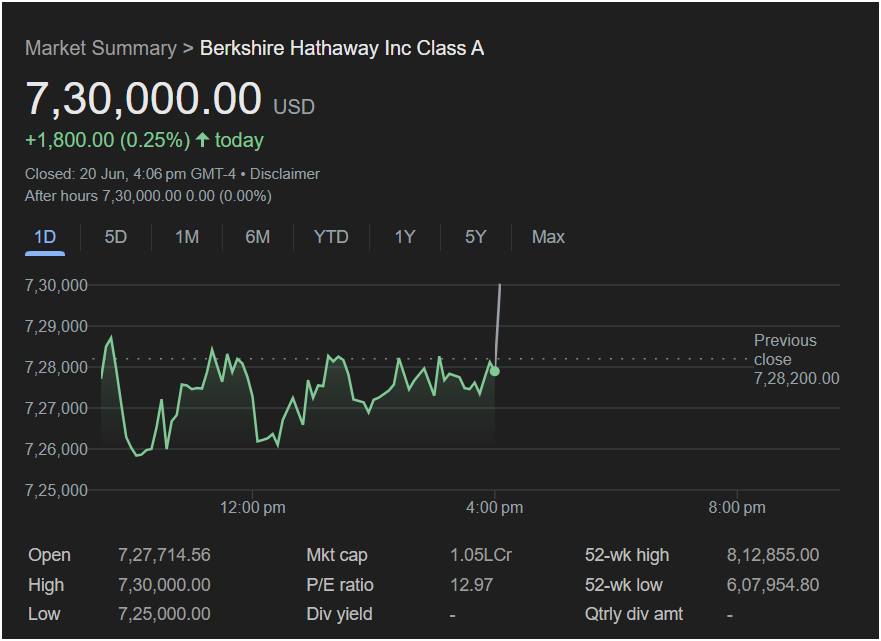

Berkshire Hathaway Inc. Class A (BRK.A) stock concluded Thursday’s session with a head-turning finale, leaving traders to ponder its next move. While the stock’s daily gain of +0.25% seemed modest on the surface, a dramatic last-minute surge sent the price to a close of exactly $730,000.00, its high for the day.

This powerful closing action, following a day of sideways trading, is a significant technical event. For traders gearing up for Monday, the key question is whether this late-day buying frenzy signals the start of a new upward leg.

Dissecting Thursday’s Trading Action

The intraday chart for Berkshire stock tells a tale of two very different trading periods.

-

A Day of Consolidation: For most of the session on June 20th, BRK.A traded within a defined range. After opening at $727,714.56, the stock fluctuated between a low of $725,000 and a high of around $729,000. This sideways movement suggested a market in equilibrium, with buyers and sellers evenly matched.

-

The Closing Spike: In the final minutes leading up to the 4:00 pm close, an immense wave of buying pressure entered the market. The stock rocketed from its trading range, blowing past the $729,000 level to close at its peak of $730,000. This type of move, known as “closing at the high,” is often interpreted as a strong bullish signal.

Key Financial Metrics to Watch

Investors should keep these critical data points in mind:

-

Closing Price: $730,000.00

-

Day’s High: $730,000.00

-

Day’s Low: $725,000.00

-

Previous Close: $728,200.00

-

52-Week Range: $607,954.80 – $812,855.00

-

P/E Ratio: 12.97

Notably, the stock’s Price-to-Earnings (P/E) ratio of 12.97 is relatively low, especially for a company of Berkshire’s stature, which could attract value-oriented investors. The stock remained flat in after-hours trading, indicating the market is taking a pause to digest the closing surge.

Market Outlook: Will the Stock Go Up or Down on Monday?

Based on Thursday’s technical action, the momentum appears to favor the bulls heading into the new week.

The Bullish Scenario:

The explosive close at the session’s absolute high is a classic sign of strength. It suggests that large institutional buyers were accumulating shares right into the bell, a move that often precedes further gains. Traders will look for this momentum to carry over, potentially pushing the stock to challenge higher resistance levels on Monday.

Points of Caution:

While the signal is strong, traders should be prepared for the possibility of a “gap fill.” The sudden spike created a price gap from the day’s trading range (below $729,000) to the close. It’s possible the stock could pull back slightly at Monday’s open to test the top of that previous range before continuing higher. The strength of the trend will be determined by whether the stock can hold above the $729,000 mark.

Is It Right to Invest?

Thursday’s dramatic finish has put Berkshire Hathaway stock squarely on the “watch list” for Monday. The powerful closing print is a significant bullish indicator that’s hard to ignore.

For traders considering a position, Monday’s open will be crucial. A sustained move above the

729,000, it would suggest the closing spike was a one-time event and that caution is warranted.

Disclaimer: This article is an analysis based solely on the provided image of stock data from a single trading day. It is not financial advice. Market conditions can change rapidly due to news, economic data, and overall market sentiment. All investors should conduct their own research and consider their risk tolerance before making any investment decisions.