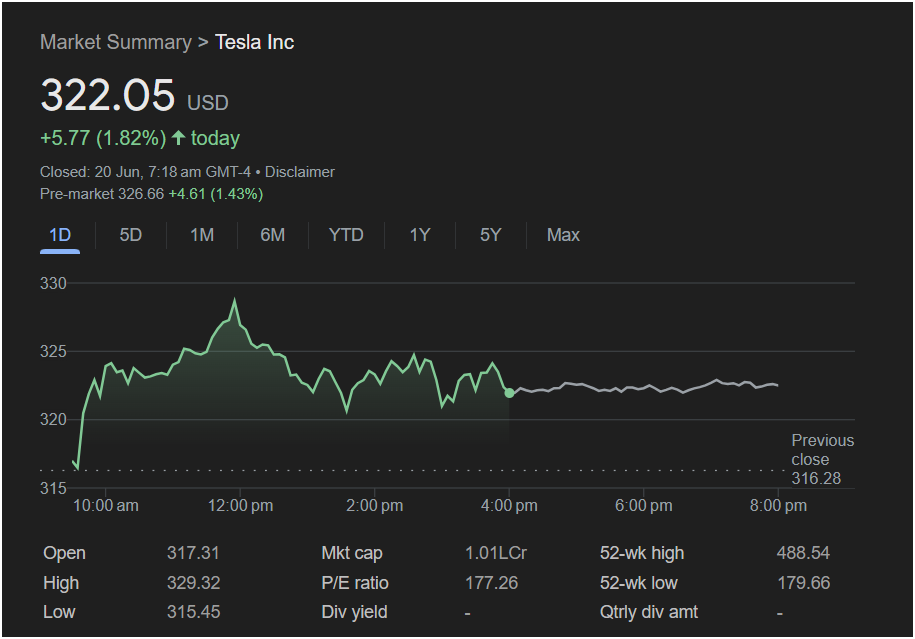

Tesla Stock Ignites with Strong Gains: Will the Bullish Momentum Continue This Monday

Tesla Inc. (TSLA) stock closed the week with a powerful upward surge, boosted by strong buying pressure that has carried over into pre-market activity. As traders and investors gear up for a new week, all eyes are on whether the electric vehicle giant can sustain this momentum. This article provides a comprehensive analysis of the key data from the chart to help you navigate Monday’s trading session.

Last Session’s Performance: A Display of Strength

On Thursday, June 20th, Tesla’s stock demonstrated significant bullish sentiment. Here’s a breakdown of the key metrics from the day:

-

Closing Price: $322.05

-

Daily Change: Up +$5.77 (+1.82%)

-

Day’s High: $329.32

-

Day’s Low: $315.45

The trading day began on a positive note, with the stock opening at $317.31, already above the previous close of $316.28. It quickly rallied, reaching a peak of $329.32 around noon. While it pulled back from this high, it found solid support and consolidated in the

324 range for the rest of the session. The strong close well above the opening price indicates that buyers remained in control throughout the day.

Pre-Market Points to a Higher Open

The most compelling signal for Monday’s session comes from the pre-market data. As of the last update, Tesla stock was trading at

4.61 (+1.43%).

What this means for traders on Monday:

-

Bullish Case: The pre-market rally strongly suggests Tesla will open significantly higher on Monday, likely above the

329.32**. A sustained move above this resistance level could attract more buyers and fuel the next leg up.

-

Bearish Case: Traders should watch for a “gap and fade” scenario. If the stock opens high but fails to push past the $329.32 resistance, it could pull back to fill the pre-market gap, potentially re-testing the $322 level.

Essential Data for Traders and Investors

Beyond the price action, these fundamental metrics provide crucial context:

-

Market Cap: $1.01 Trillion (shown as 1.01L Cr). Tesla remains a titan of the market, commanding significant investor attention.

-

P/E Ratio: 177.26. This exceptionally high price-to-earnings ratio is a hallmark of Tesla stock. It indicates that investors have priced in massive future growth and profitability. It also contributes to the stock’s renowned volatility.

-

52-Week Range: $179.66 – $488.54. The current price is firmly in the middle of its one-year range. This shows there is significant room for potential upside before reaching its prior peak, but it is also far from its recent lows.

-

Dividend Yield: None. As a growth-focused company, Tesla reinvests its profits back into the business rather than paying dividends.

Is It Right to Invest Today?

For Short-Term Traders:

The immediate indicators are overwhelmingly bullish. The combination of a strong closing day and a significant pre-market rally points toward continued upward momentum at the start of the week. The key strategy for Monday is to watch the $329.32 resistance level. A decisive break above it could be a clear buy signal for a short-term trade.

For Long-Term Investors:

A long-term investment in Tesla is a bet on its disruptive technology in EVs, AI, and energy. The recent price action is positive, but the decision to invest should be based on your conviction in the company’s long-term vision and your tolerance for its high valuation (P/E ratio) and volatility. Buying now would be buying into strength, but it’s crucial to be prepared for the sharp price swings characteristic of this stock.

In summary, Tesla stock enters the week with significant bullish momentum, backed by strong pre-market buying. While a higher open seems very likely, the stock’s ability to conquer the $329.32 resistance level will be the key determinant of its trajectory for the day and the week ahead.