ADP Stock Sees Volatile Session, What Do the Signals Suggest for Monday

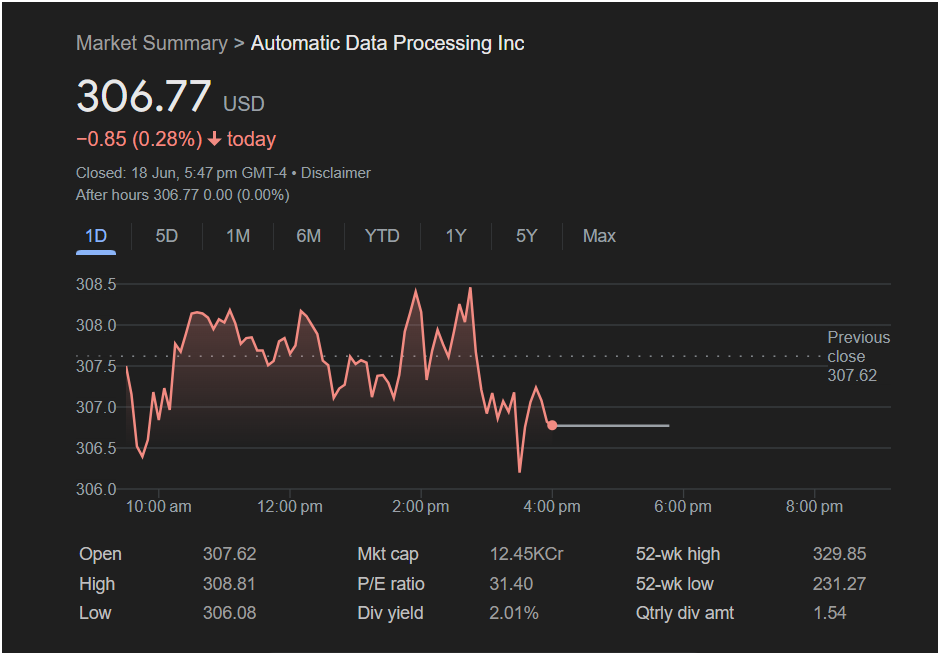

Automatic Data Processing Inc. (ADP) stock concluded a highly volatile trading day with a loss, closing at $306.77, down 0.28%. The session on June 18th was marked by significant price swings, leaving traders to dissect the day’s action for clues about the stock’s next move when the market opens on Monday.

For any trader evaluating ADP, understanding the day’s narrative and the key underlying metrics is crucial.

Today’s Trading Recap: A Tale of Two Halves

The 1-day chart for ADP paints a picture of intense intraday struggle between buyers and sellers. The stock opened at $307.62, identical to the previous day’s close, but quickly dipped to its low for the day at $306.08.

From there, buyers stepped in aggressively, pushing the stock on a steady climb to its daily high of $308.81 in the mid-afternoon. However, this peak was short-lived. A sharp and decisive sell-off erased all the day’s gains, driving the price back down before it settled at $306.77. After-hours trading remained completely flat, indicating a pause in activity rather than a shift in sentiment.

Key Metrics Every Trader Must Know

Key Metrics Every Trader Must Know

Beyond the price chart, ADP’s financial vitals provide essential context:

-

P/E Ratio: Standing at 31.40, ADP’s Price-to-Earnings ratio suggests that the market has high expectations for the company’s stability and future earnings growth. It is not considered a “value” stock but rather a high-quality, premium-priced company.

-

Dividend Yield: The 2.01% dividend yield is a solid return for a stable, large-cap company. With a quarterly dividend of $1.54 per share, it rewards long-term shareholders but isn’t high enough to be the primary reason for investment, unlike some utility or telecom stocks.

-

52-Week Range: The stock is currently trading in the upper end of its 52-week range of $231.27 to $329.85. This shows strong performance over the past year, though it is currently trading off its recent highs.

-

Market Capitalization: At 12.45KCr (an indicator of a market cap of approximately $124.5 Billion), ADP is a blue-chip leader in its industry.

Market Forecast: Will ADP Stock Go Up or Down?

The conflicting signals from Friday’s session make predicting Monday’s direction challenging.

The Bullish Case (Reasons for Optimism):

-

Strong Midday Rally: The powerful rally to $308.81 demonstrates that there is significant buying interest in ADP, especially on dips.

-

Blue-Chip Status: As a market leader, ADP is often seen as a “safe haven” investment, and institutional buyers may use any price weakness as a long-term entry point.

-

Positive Yearly Trend: The stock is still performing well within its 52-week range, suggesting the broader trend remains positive.

The Bearish Case (Reasons for Caution):

-

Sharp Rejection from Highs: The most concerning signal is the aggressive sell-off from the day’s peak. This “reversal” pattern indicates that sellers overwhelmed buyers at higher prices and were in firm control at the market close.

-

Closing in the Red: Finishing below the previous day’s close and well off the daily high carries negative momentum into the next trading session.

-

Flat After-Hours: The lack of a bounce-back in after-hours trading suggests an absence of immediate bargain hunters.

Is It Right to Invest in ADP Today?

Your investment approach should dictate your next move.

-

For long-term investors who believe in ADP’s business model of providing essential human resources and payroll services, this volatility may be noise. A slight dip could be viewed as a minor discount on a high-quality, dividend-paying company.

-

For short-term or swing traders, extreme caution is warranted. The sharp afternoon reversal is a bearish signal. A prudent approach would be to wait for the market to open on Monday. A break below the day’s low of $306.08 could signal further downside, while a move back above the $307.50 level might indicate the bulls are regaining control.

In summary, ADP stock is at a pivotal point. While its long-term fundamentals are solid, the short-term technical picture is clouded by the late-day sell-off. The opening trades on Monday will be critical in determining whether the stock can shake off this negativity or if a deeper pullback is imminent.

Disclaimer: This article is for informational purposes only and is based on the data from the provided screenshot. It is not financial advice. Please conduct your own research and consult with a financial professional before making any investment decisions.