Booking Holdings Stock (BKNG) Falters: Key Levels to Watch for the Next Trading Session

Booking Holdings Inc. (ticker: BKNG) experienced a downward trend in its latest trading session, leaving investors and traders to carefully consider its next move. After a volatile day, the travel technology giant’s stock closed in the red. This article breaks down the day’s performance and analyzes what traders should be watching.

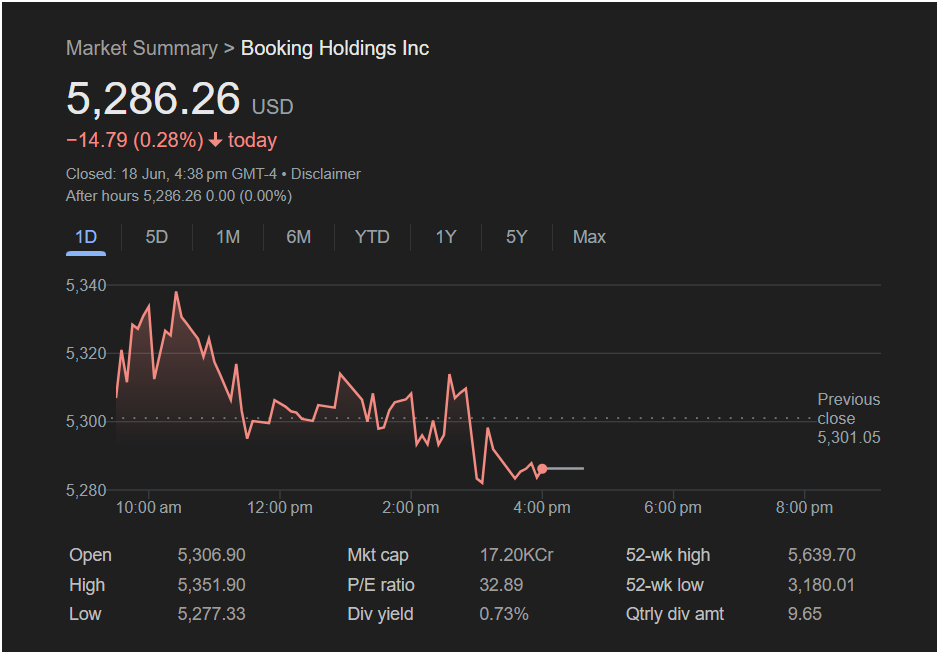

On Tuesday, June 18, Booking Holdings stock closed at

14.79 (0.28%) for the day. The after-hours market showed no immediate change, suggesting a period of consolidation before the next market open.

Tuesday’s Trading Day in Review

Tuesday’s Trading Day in Review

The trading session for BKNG was a tale of early strength followed by a sustained sell-off. The stock opened at $5,306.90, higher than the previous close of

5,351.90** in the morning.

However, the stock could not maintain this momentum. Throughout the afternoon, sellers took control, pushing the price steadily lower. It eventually hit a day’s low of $5,277.33 before a minor bounce into the close. The fact that the stock closed near its daily low suggests bearish sentiment may carry over into the next session.

Key Financial Metrics for Traders

Here is a summary of the vital statistics from the trading day that every trader needs to know:

-

Closing Price: $5,286.26

-

Day’s Range: $5,277.33 (Low) – $5,351.90 (High)

-

52-Week Range: $3,180.01 – $5,639.70

-

P/E Ratio: 32.89

-

Dividend Yield: 0.73%

-

Market Cap: Approximately $135 Billion

-

Quarterly Dividend Amount: $9.65

The stock is currently trading closer to its 52-week high than its low, indicating a strong long-term uptrend despite the recent daily pullback.

Outlook: Will the Stock Go Up or Down?

Please note: US markets are closed on Wednesday, June 19th, for the Juneteenth holiday. The next trading session will be on Thursday, June 20th.

Predicting short-term market movements is inherently challenging, but we can analyze key technical levels to anticipate potential scenarios.

Bearish Case: The downward momentum from Tuesday’s afternoon session is a significant indicator. If the stock opens on Thursday and breaks below the recent support level of $5,277.33, it could signal further declines. The next psychological support level might be found around the $5,250 mark.

Bullish Case: For those looking for an entry point, this dip could be seen as a buying opportunity. The intraday low of

5,300** price point (near the previous close), it could be a sign that buyers are stepping back in to defend the price. A move above the day’s midpoint (~$5,315) would be a stronger confirmation of renewed bullish interest.

Is it Right to Invest Today?

This decision depends entirely on your investment strategy and risk tolerance.

-

For Long-Term Investors: A single day’s decline of 0.28% is minor in the context of Booking’s strong performance over the past year. If you believe in the company’s fundamentals and the long-term growth of the travel industry, this small dip might be an attractive entry point to initiate or add to a position.

-

For Short-Term Traders: Caution is advised. The stock closed weak, and the path of least resistance appears to be downwards in the very short term. A prudent strategy would be to wait for a clear sign of a reversal or for the stock to establish a new support base before committing capital. Watching the opening price action on Thursday will be critical.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. All investment decisions should be made based on your own research and consultation with a qualified financial advisor.