AMZN Stock Analysis: Amazon Dips Below $213, What Should Traders Watch Next

NEW YORK – Amazon.com Inc. (NASDAQ: AMZN) stock experienced a notable downturn in Tuesday’s trading session, closing in the red and leaving investors to carefully weigh their next move. The tech giant’s shares ended the day reflecting broader market pressure, and this article breaks down the key data points for any trader keeping a close eye on this widely-held stock.

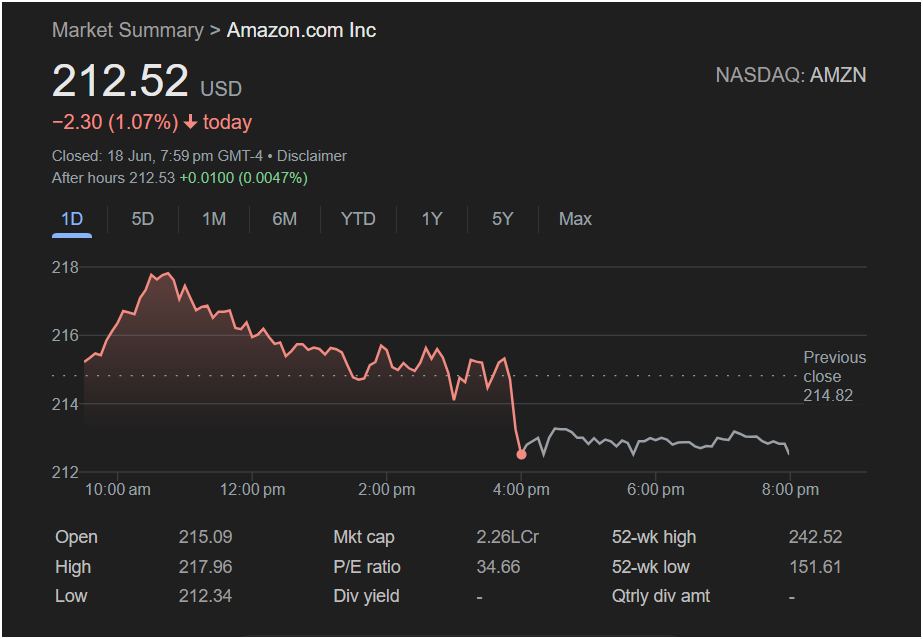

On Tuesday, June 18th, Amazon stock closed at

2.30, or 1.07%, for the day. The trading session was characterized by early strength that quickly faded, setting a bearish tone for the remainder of the day.

Today’s Trading Session Recap

The stock opened the day at $215.09, slightly above the previous close of $214.82, and quickly rallied to a session high of $217.96. However, this early optimism was short-lived. Sellers took control, pushing the price steadily downward throughout the afternoon. The most significant drop occurred near the 4:00 PM EST market close, with the stock hitting its daily low of $212.34 before a minor recovery to its final closing price.

After-hours trading showed minimal activity, with the stock inching up by a fraction to $212.53, suggesting a period of consolidation after the day’s volatile move.

Key Financial Metrics for Traders

To make an informed decision, traders need to consider all the vital statistics from the trading day:

-

Closing Price: $212.52 USD

-

Day’s Change: -$2.30 (-1.07%)

-

Day’s Trading Range: $212.34 (Low) to $217.96 (High)

-

Previous Close: $214.82

-

52-Week Range: $151.61 to $242.52

-

Market Cap: Approximately $2.26 Trillion

-

P/E Ratio: 34.66

-

Dividend Yield: N/A

Market Outlook: Will the Stock Go Up or Down?

Based on Tuesday’s performance, the short-term sentiment for Amazon stock appears cautious. Here’s a breakdown of what to watch for in the upcoming trading sessions:

-

Support Level: The day’s low of $212.34 acts as the immediate support level. If the stock breaks below this point in the next session, it could signal further downward momentum and attract more sellers.

-

Resistance Level: On the upside, the first key resistance level is the previous close of $214.82. For buyers to regain control, the stock would need to decisively break above this price, with the next target being the day’s high of around $218.

Closing near the day’s low is often interpreted as a bearish signal, suggesting that sellers were in control right until the end of the session. Traders will be looking for confirmation at the next market open. A gap down would confirm the bearish trend, while a strong open above $213 could indicate that the dip was a temporary pullback.

Is it the Right Time to Invest in Amazon Stock?

The decision to invest is highly dependent on your personal strategy and risk tolerance.

-

For Long-Term Investors: A price drop in a fundamentally strong company like Amazon can be viewed as a buying opportunity. If you believe in the company’s long-term growth prospects, acquiring shares at a lower price point could be advantageous. The P/E ratio of 34.66, while not low, is reasonable for a high-growth tech leader.

-

For Short-Term Traders: The current momentum is negative. A cautious trader might wait to see if the stock can establish a solid base at the $212 support level before entering a new position. The downward pressure at the close suggests that entering a “buy” position immediately could be risky without signs of a reversal.

In conclusion, Tuesday’s session put Amazon stock on the defensive. The critical test for the next trading day will be whether it can hold the $212 support level. Investors should monitor the opening price and volume closely to gauge market sentiment before making any investment decisions.

Disclaimer: This article is for informational and analytical purposes only and should not be considered financial advice. Stock market trading involves risk, and you should conduct your own research or consult with a qualified financial advisor before making any investment decisions.