Eaton Corporation Stock Jumps Over 1%: A Trader’s Analysis of Today’s Bullish Move

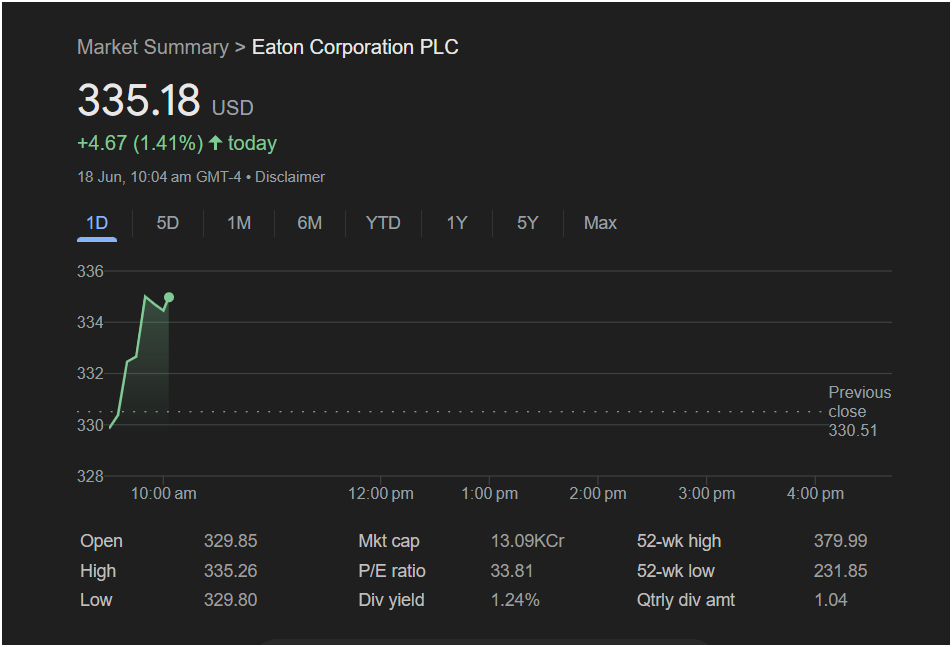

Eaton Corporation PLC (NYSE: ETN) is demonstrating significant bullish momentum in today’s trading session, making it a key stock for traders to watch. As of 10:04 AM GMT-4 on June 18, the stock is trading at an impressive

4.67, which translates to a strong 1.41% gain for the day. This powerful move signals strong buyer interest and sets a positive tone for the session.

Today’s Trading Dynamics

Today’s Trading Dynamics

The intraday chart for Eaton reveals a story of sustained buying pressure right from the market open. The stock opened at $329.85, slightly below the previous close of $330.51, and briefly touched a low of $329.80. However, that dip was short-lived as buyers immediately took control, driving the price on a steep and steady upward trajectory.

The stock has since rallied to a session high of $335.26, trading near this peak at the time of this analysis. This strong, consistent climb without significant pullbacks indicates a high level of bullish conviction and suggests that market sentiment is firmly positive for Eaton today.

Key Financial Metrics for Your Radar

Traders evaluating Eaton’s potential should consider these fundamental data points:

-

Market Cap: 13.09KCr. (This notation likely represents approximately $130.9 Billion USD), solidifying Eaton’s position as a major player in the power management industry.

-

P/E Ratio: 33.81. This indicates that investors are willing to pay a premium for Eaton’s earnings, a common characteristic of companies with strong growth prospects.

-

Dividend Yield: 1.24%. While modest, the dividend provides a small income stream, backed by a Quarterly Dividend Amount of $1.04 per share.

-

52-Week Range: The stock is currently trading between its 52-week low of

379.99. Its position in the upper end of this range confirms a strong, long-term uptrend.

Analysis: Should You Invest Today?

Given the powerful start, what can traders expect for the rest of the day and potentially into Monday’s session?

The Bullish Case (Why it Might Go Higher):

The overwhelming evidence from the intraday chart is bullish. The stock has shown a clear upward trend with minimal resistance, suggesting the path of least resistance is currently up. Trading significantly above the previous day’s close and showing a gain of over 1.4% early in the day is a powerful signal. For momentum traders, this is exactly the kind of price action they seek. The stock’s performance within its 52-week range also confirms a healthy, ongoing uptrend.

The Bearish Case (Points of Caution):

While momentum is strong, the P/E ratio of 33.81 suggests the stock is not “cheap.” Its valuation reflects high expectations, which means any negative news could trigger a sharp correction. Furthermore, as the price moves closer to its 52-week high of $379.99, it may encounter profit-taking and increased selling pressure, creating a potential resistance zone.

The Bottom Line for Traders

For a day trader, the bullish momentum is undeniable. The key is to watch if the stock can sustain this upward drive and potentially break through the session high of $335.26 with conviction. A hold above this level could signal further gains throughout the day.

For a swing trader or long-term investor, today’s action reinforces the stock’s strong uptrend. While the entry price is elevated compared to its 52-week low, the company’s market leadership and consistent performance make it a core holding for many. The current valuation calls for careful consideration, but for those betting on continued growth in the power management and electrical sectors, Eaton remains a top-tier candidate. Investing today aligns with the current bullish trend, but as always, risk management is key.

Disclaimer: This article is an analysis based solely on the provided image and data at a specific point in time. Market conditions are dynamic and can change rapidly. It is not financial advice. All traders and investors should conduct their own research and consider their risk tolerance before making any investment decisions.