Thermo Fisher Scientific Stock Tumbles, Hits 52-Week Low: A Trader’s Analysis

Traders are closely watching Thermo Fisher Scientific stock (NYSE: TMO) this morning after it experienced a significant drop at the market open, raising questions about its short-term trajectory. An analysis of the early trading session on Tuesday, June 18th, reveals several critical data points that investors should consider.

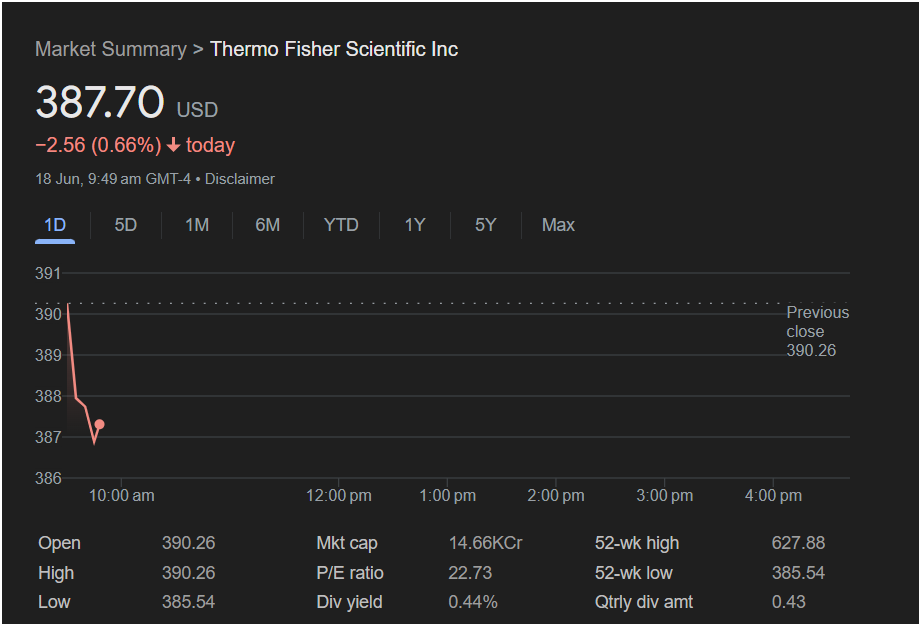

As of 9:49 AM GMT-4, the stock was trading at $387.70, a decrease of $2.56 or 0.66% for the day. This price action places the stock under immediate bearish pressure.

Today’s Trading Activity at a Glance

The provided data paints a clear picture of the morning’s session:

-

Sharp Opening Decline: The stock opened at $390.26, the same as its previous close. However, it immediately faced strong selling pressure, as seen in the steep downward slope on the 1-day chart. The high for the day so far is the opening price itself, indicating a lack of any upward momentum.

-

A Critical New Low: The most significant event of the morning is the stock hitting a new 52-week low of $385.54. This is a major technical indicator that often signals a strong bearish trend and a breakdown of prior support levels. While the price has slightly recovered to $387.70, it remains precariously close to this new low.

-

Current Position: The current price is substantially lower than the 52-week high of $627.88, highlighting the longer-term downward pressure the stock has been under.

Key Financial Metrics for Context

Key Financial Metrics for Context

While the price action tells the immediate story, other metrics provide a broader view for the informed trader:

-

P/E Ratio: At 22.73, the price-to-earnings ratio is moderate, suggesting the stock isn’t in extreme overvaluation territory.

-

Dividend Yield: The yield is a modest 0.44%, with a quarterly dividend amount of $0.43. For income investors, this is a relatively small return.

-

Market Cap: The market capitalization is listed as 14.66KCr, indicating it remains a large-cap company with a significant market presence.

Will the Market Go Up or Down? A Trader’s Outlook for Monday and Beyond

Based on the data from Tuesday morning, the immediate sentiment for Thermo Fisher Scientific is bearish. Hitting a 52-week low is a powerful signal that sellers are in control.

For any trader considering an investment, here is the breakdown:

-

For the Bearish Trader: The break below the previous 52-week low could be seen as confirmation of a continued downtrend. The failure to gain any upward momentum from the open reinforces this negative outlook.

-

For the Bullish Trader (Contrarian View): Some may view the bounce off the absolute low of $385.54 as potential dip-buying or the start of a support-building process. However, investing now would be a high-risk “falling knife” scenario. A prudent bullish investor would likely wait for the price to stabilize and show signs of a confirmed reversal before committing capital.

for Today and the Week Ahead:

The stock is in a technically vulnerable position. The primary focus for any trader on Monday, or any day this week, should be whether the price can hold above the new 52-week low of $385.54. If it continues to fall below this level, further declines could be expected. If it manages to build a base and climb back above the $390 mark, it might signal that the worst of the selling is over. Given the high volatility and strong downward pressure, caution is strongly advised.

Disclaimer: This article is for informational purposes only and is based on the data provided in the screenshot. It does not constitute financial advice. All investment decisions should be made with the help of a qualified financial professional after conducting your own thorough research.