Honeywell Stock Dips Below Key Level: What Traders Are Watching Next

New York, NY – Honeywell International Inc. (NYSE: HON) saw its

-

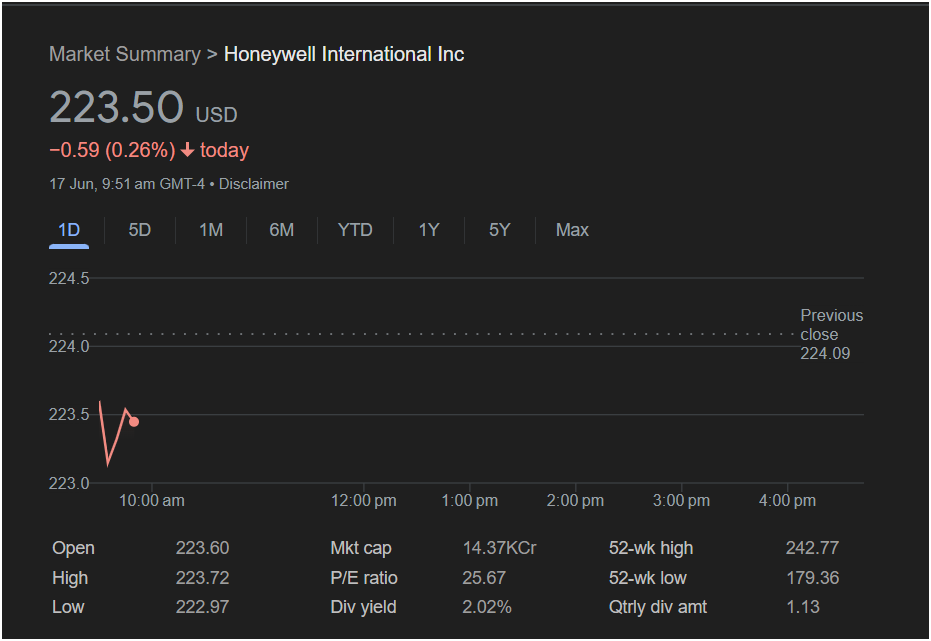

Key Resistance Level: The most critical observation is that the stock is currently struggling to reclaim the previous stock price dip in early trading Friday, presenting a mixed picture for investors. As of 9:51 am GMT-4 close of 224.09. This price is now acting as a short-term resistance level. For, Honeywell stock was trading at 223.50 USD, down 0.59 USD or 0.26% for the day. This move has traders carefully analyzing key metrics and chart levels to determine the stock to show bullish momentum, it would need to decisively break above this mark.

This V-shaped movement in the first hour suggests that while sellers initiated the downward pressure at the open, buyers did step in at the lows. However, the inability the stock’s potential direction for the upcoming week.

Based on the trading data from Friday, June 17th, here to sustain that upward momentum and turn positive for the day indicates that sellers still have a slight edge.

Core Financial Metrics: is a comprehensive breakdown of what investors and traders need to know.

Core Financial Metrics: is a comprehensive breakdown of what investors and traders need to know.

Today’s Market Action

Honeywell stock opened the A Look at the Bigger Picture

Beyond the immediate price action, the fundamental data provides essential context for different types of investors: day at 223.60 USD, slightly below the previous day’s close of 224.0

-

Valuation (P/E Ratio): At 25.67, Honeywell’s price9 USD. The price action in the first hour of trading showed some volatility, with the stock hitting an intraday low of-to-earnings ratio suggests a moderate valuation, typical for a stable, large-cap industrial company.

-

222.97 USD before attempting a modest recovery. The high for the session so far stands at 22Income Generation (Dividend): With a dividend yield of 2.02% and a quarterly dividend payment of **3.72 USD.

The critical takeaway from the intraday chart is that the stock is currently struggling to reclaim$1.13 per share**, HON remains an attractive option for income-focused and long-term investors.

-

** the previous closing price of 224.09 USD, which may now act as a short-term resistance levelMarket Position (52-Week Range):** The stock is trading squarely between its 52-week low of 179.36 and its 52-week high of 242.77. This indicates it is not. The V-shaped bounce from the day’s low suggests that some buyers stepped in, but the overall sentiment in the early session remains cautious.

Key Financial Metrics at a Glance

For those looking beyond the daily fluctuations, Honeywell at an extreme, having recovered significantly from its lows but still sitting well below its peak.

-

**Market Capitalization’s fundamentals provide important context:

-

P/E Ratio: Standing at 25.67, this:** The figure of 14.37KCr translates to approximately $144 billion, cementing Honeywell indicates how the market values the company relative to its earnings.

-

Dividend Yield: The stock offers a **2’s status as a blue-chip, large-cap leader in its sector.

Will the Stock Go Up.02%** dividend yield, with a quarterly dividend amount of $1.13 per share. This or Down on Monday?

Based solely on this snapshot, here are two potential scenarios for Monday’s trading session:

** can be an attractive feature for income-focused investors, providing a steady return even during periods of price consolidation.

-

The Bullish Case:** If the buying pressure seen at the day’s low (222.97) continues52-Week Range: Honeywell has traded between a low of 179.36 USD and a high of 242.77 USD over the past year. The current price of 223 and the stock can break through the 224.09 resistance level, it could signal a reversal of the early.50 USD places it in the upper end of this range, suggesting underlying long-term strength despite the minor daily pullback weakness. This would suggest that Friday’s dip was a minor pullback and that the broader trend could resume upward.

The Bearish Case: If the stock fails to overcome the 224.09 level and falls back below the day. It is currently trading about 8% below its 52-week high.

Outlook: Will it’s low of 222.97, it could indicate that sellers are taking control. This might lead to further downside be Right to Invest?

Predicting short-term market movements is always challenging, but traders will be watching specific price pressure at the start of next week, potentially targeting lower support levels.

**Conclusion: Is it Right to Invest Today? levels as indicators for Monday’s session.

For a potential bullish case: If buyers can push the price back**

For short-term traders, the current situation is one of caution. The key is to watch whether the stock can reclaim above the 224.09 USD (previous close) level, it could signal a reversal of the morning its previous closing price. A long position might be considered on a confirmed break above 224.09, while a’s weakness and a potential move toward higher levels.

For a potential bearish case: If the stock fails to hold its break below 222.97 could be a bearish signal.

For long-term investors, Friday’s minor ground and breaks below the day’s low of 222.97 USD, it could indicate further selling fluctuation is less significant. The solid dividend yield and Honeywell’s established market position remain appealing. A price dip could even pressure is on the horizon, potentially leading to a deeper pullback.

Conclusion for Traders:

The decision to invest in be viewed as a potential buying opportunity for those looking to build a position over time.

Ultimately, the market will be looking Honeywell stock today or heading into next week depends heavily on an individual’s investment strategy.

-

Short-term traders for a decisive move. The price action at the close on Friday and the open on Monday will be crucial in determining whether Honeywell may see the current dip as a point of indecision and will be watching the key support and resistance levels mentioned above for a stock will climb higher or face another test of its recent lows.

*Disclaimer: This article is for informational purposes clear signal.

-

Long-term investors might view the current price as a reasonable entry point, considering only and is based on the data provided in the screenshot. It does not constitute financial advice. All investment decisions should be the stock is off its yearly highs and offers a solid 2.02% dividend yield. The company’s made with the consultation of a qualified financial professional.* position as an industrial conglomerate provides a degree of stability that many find appealing for a core portfolio holding.

Ultimately, while Friday’s early trading shows slight weakness, the broader context of Honeywell’s performance within its 52-week range and