Applied Materials Stock Shows Early Volatility: A Trader’s Analysis for Monday, June 17

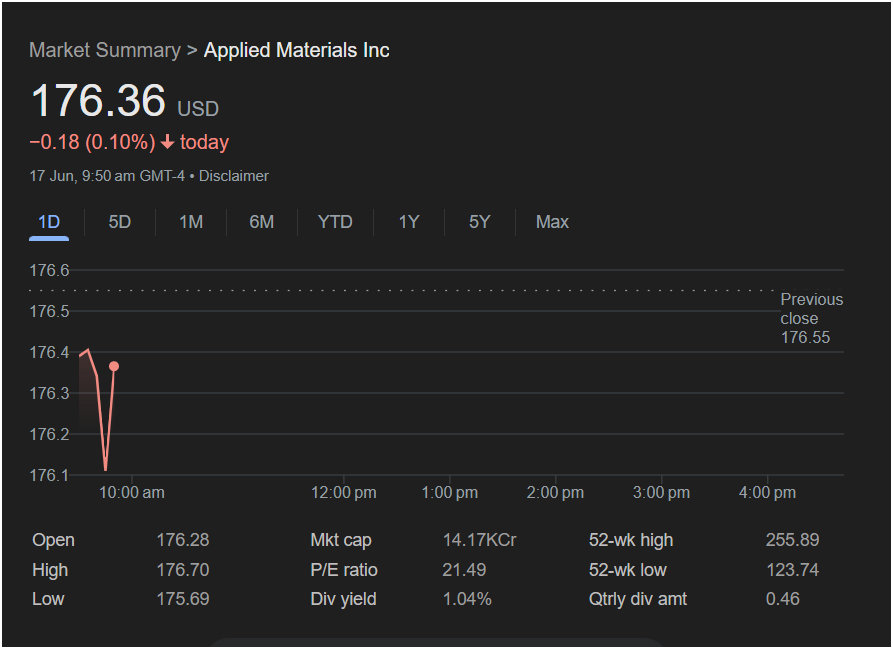

Applied Materials stock (NASDAQ: AMAT) is experiencing a volatile start to the trading week, presenting a complex picture for traders on Monday. As of 9:50 am GMT-4, the stock is trading at 176.36 USD, marking a slight downturn of -0.18 (0.10%) for the day. While the dip is minor, the intraday chart reveals a tug-of-war between buyers and sellers that requires careful attention.

This article breaks down all the critical information from the market summary to help you understand the potential direction of Applied Materials stock today and whether it aligns with your trading strategy.

Intraday Price Action: A Sharp Dip and Quick Recovery

The one-day (1D) chart provides the most immediate story for day traders. Here’s what we see in the first 20 minutes of the market open:

-

Opening Price: The stock opened at 176.28 USD, slightly below the previous close of 176.55 USD.

-

Immediate Volatility: After the open, the price quickly dropped to a daily low of 175.69 USD before sharply rebounding.

-

Current Position: The current price of 176.36 USD shows a partial recovery from the morning’s low but remains below the day’s high of 176.70 USD and the previous day’s closing price.

This “V-shaped” pattern in the opening minutes suggests that while there was initial selling pressure, buyers stepped in at the lower price point. For a trader, the key question is whether this buying momentum can be sustained to push the stock above the previous close and the daily high, or if sellers will regain control.

Key Financial Metrics at a Glance

Key Financial Metrics at a Glance

To make an informed decision, a trader must look beyond the immediate price action. Here are the fundamental metrics provided:

-

Market Cap: 14.17KCr (Note: This likely represents Indian numbering for Crores, translating to approximately $170 billion USD, confirming its status as a large-cap company).

-

P/E Ratio: 21.49. This is a moderate price-to-earnings ratio for a semiconductor giant, suggesting the stock is not excessively overvalued based on its past earnings.

-

Dividend Yield: 1.04%. The company offers a modest dividend, providing a small but steady return to long-term investors.

-

Quarterly Dividend Amount: 0.46 USD.

-

52-Week High: 255.89 USD

-

52-Week Low: 123.74 USD

The Bigger Picture: Long-Term Strength vs. Short-Term Weakness

The most crucial insight comes from comparing the current price to its 52-week range. At 176.36 USD, Applied Materials stock is trading significantly closer to its 52-week high than its low. This indicates a strong upward trend and powerful positive momentum over the past year.

Today’s minor dip can be viewed in this context: it could be a small, healthy pullback or a consolidation period after a significant run-up. Investors with a longer time horizon may see this as a period of stability, whereas short-term traders will focus on the intraday battle around the key 176.55 USD (previous close) level.

Is It Right to Invest Today?

Based on this snapshot, Applied Materials stock presents a mixed signal. The long-term trend is undeniably strong, but the short-term price action shows indecision.

-

For the Bullish Trader: A break above the day’s high (176.70) and the previous close (176.55) could signal that the morning dip was a bear trap and the upward trend is resuming.

-

For the Cautious/Bearish Trader: If the stock fails to reclaim these levels and falls back towards the daily low (175.69), it could indicate that sellers are in control for the session.

: Today is a day for observation. While the fundamentals of Applied Materials appear solid, the early market volatility on Monday warrants caution. Traders should watch these key price levels closely to gauge market sentiment before committing to a position. The battle between the stock’s strong long-term momentum and its slight short-term weakness will define today’s trading session.

Disclaimer: This article is for informational purposes only and is based on a single point-in-time screenshot. It does not constitute financial advice. Stock market conditions are highly volatile and can change rapidly. All investors should conduct their own thorough research and consult with a qualified financial advisor before making any investment decisions.