Thermo Fisher Scientific Stock Pressured Near 52-Week Low: What’s Next for TMO

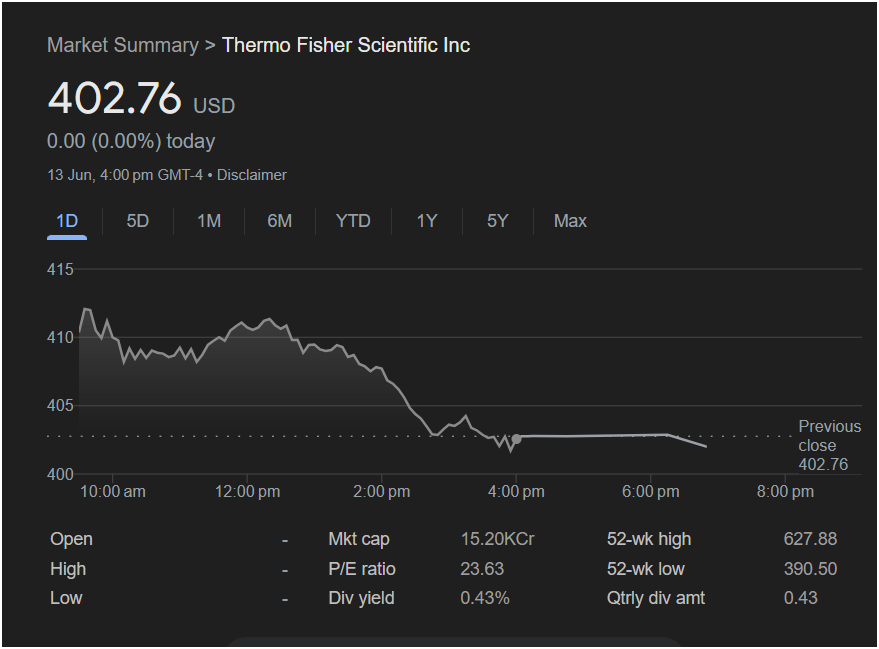

New York, NY – Thermo Fisher Scientific Inc. (NYSE: TMO) stock is facing a significant test as it heads into the new trading week, closing the last session at $402.76. While the official daily change was 0.00%, this figure masks a day of intense selling pressure that pushed the stock alarmingly close to its 52-week low, setting a cautious tone for Monday’s open.

For traders and investors, understanding the dynamics of this recent price action is crucial. Here’s a comprehensive breakdown of what the chart and data are telling us.

Intraday Technical Analysis: Sellers Dominate the Session

Intraday Technical Analysis: Sellers Dominate the Session

The one-day (1D) chart for Thermo Fisher reveals a clear bearish trend. The stock began the day on a strong footing, trading above the $410 level and reaching a session high near $412. However, this strength evaporated as the day progressed.

Starting in the early afternoon, a sustained wave of selling hit the stock, driving it down through multiple support levels. The price broke below the psychologically important

400**. The stock’s inability to mount any meaningful recovery before the close is a significant red flag. This weak finish near the bottom of the daily range indicates that sellers were in full control at the end of the day, and this negative momentum could easily spill over into the next trading session.

Key Levels for Traders to Watch:

-

Support: The most critical support level is the 52-week low of $390.50. The $400 psychological level will act as the first line of defense. A break below these levels could accelerate the downtrend.

-

Resistance: On the upside, the stock would need to reclaim the

412** represents the next major resistance zone.

Fundamental Snapshot: Value or Vulnerability?

The financial metrics provide essential context for the technical picture:

-

Proximity to 52-Week Low: At

390.50**. This is a precarious position. While some may see it as a potential value opportunity, it also signifies profound market weakness and negative sentiment surrounding the stock.

-

P/E Ratio (23.63): A Price-to-Earnings ratio of 23.63 is moderate for a company of Thermo Fisher’s stature. It doesn’t suggest the stock is excessively overvalued, meaning the current sell-off may be driven more by market sentiment or industry-specific headwinds rather than a valuation bubble.

-

Dividend Yield (0.43%): The very low dividend yield of 0.43% confirms that TMO is primarily considered a growth stock, not an income investment. This means the dividend is unlikely to provide a strong support “floor” for the share price during a downturn.

Outlook: Should You Invest Today?

For Short-Term Traders: The outlook for Monday is decidedly cautious. The strong bearish momentum and the close near the session low suggest that the path of least resistance is to the downside. Traders should watch for a potential test of the $400 level and the 52-week low at $390.50. Entering a long position now would be akin to catching a falling knife and carries significant risk.

For Long-Term Investors: The current price level presents a dilemma. On one hand, buying a world-class company like Thermo Fisher, a leader in the scientific instruments and life sciences sector, near its 52-week low can be a great long-term strategy. It could be an opportunity to acquire shares at a discount. On the other hand, it’s vital to understand the reasons for the weakness. If the headwinds are temporary, this is a buying opportunity. If they are fundamental and long-lasting, the stock could have further to fall.

In conclusion, Thermo Fisher Scientific stock is in a technically weak position. The immediate forecast leans bearish, with critical support levels under threat. While it may be an attractive entry point for patient, long-term investors, short-term traders should exercise extreme caution and wait for signs of a clear price reversal before committing capital.

Disclaimer: This article is for informational and analytical purposes only and should not be considered financial or investment advice. All trading and investment decisions should be made with the consultation of a qualified financial professional.