Alzamend Neuro Stock: A Green Day Hiding Red Flags for Traders

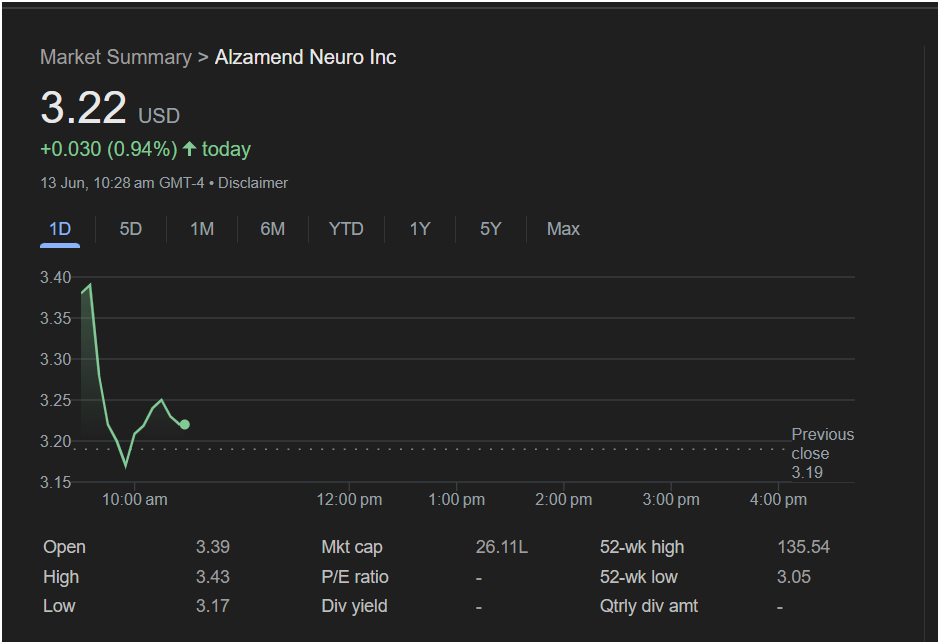

The Alzamend Neuro Inc. stock is showing a gain on the screen today, but a closer look at its intraday price action reveals a potentially bearish pattern that traders must be aware of. While technically in the green, the stock’s performance after the market open tells a story of significant volatility and selling pressure. This analysis, based on a market snapshot from June 13th at 10:28 AM GMT-4, will dissect every critical data point to provide a comprehensive guide for traders evaluating this high-risk stock.

Extreme Risk Warning: This article analyzes an unprofitable, nano-cap stock that has experienced a catastrophic long-term decline. The risk of sudden, severe, and complete loss of capital is exceptionally high. This information is for educational purposes only and is not financial advice. Trading stocks like this is extremely speculative.

Part 1: The Deceptive Intraday Chart – The “Gap and Fade”

Part 1: The Deceptive Intraday Chart – The “Gap and Fade”

At first glance, the stock’s performance seems positive. However, the details reveal a classic trap for unwary traders.

-

Current Price: 3.22 USD

-

Today’s Change: Up +0.030 (+0.94%)

-

The Hidden Story: The positive number masks significant intraday weakness.

Let’s break down the chart’s narrative:

-

The Gap Up: The stock closed yesterday at 3.19 but opened today at 3.39. This significant “gap up” suggests a surge of pre-market buying interest, likely driven by news or hype.

-

The Spike and Rejection: Immediately after the open, the stock spiked to a high of 3.43.

-

The Fade: Sellers immediately stepped in, driving the price all the way down to a low of 3.17. This reversal pattern, where a stock gaps up only to sell off, is known as a “gap and fade” and is a very bearish short-term signal.

Trader’s Takeaway: This is not a picture of strength. It suggests that early buyers who caused the gap up are now selling to take quick profits, and new buyers are not strong enough to absorb the selling pressure. The key levels for the rest of the day are the low of 3.17 (support) and the high of 3.43 (resistance).

Part 2: The Alarming Long-Term Context

The fundamental data paints an even riskier picture.

-

P/E Ratio (-): The absence of a P/E ratio confirms that Alzamend Neuro is not a profitable company. Its valuation is based entirely on speculation about its future prospects, not current performance.

-

Market Cap (26.11L): While the “L” notation is unusual for US stocks (often meaning Lakh in India), it points to a very small market capitalization, likely in the nano-cap range (under $50 million). Nano-cap stocks are extremely volatile and illiquid.

-

52-Week Range (3.05 – 135.54): This is the most critical piece of information on the screen. The stock has collapsed by over 97% from its one-year high. This signals a catastrophic, long-term downtrend and a massive loss of investor confidence.

-

Proximity to 52-Week Low: The daily low of 3.17 is just cents away from the 52-week low of 3.05. This yearly low is now the ultimate line in the sand for the stock.

Part 3: The Speculator’s Choice – Gamble on a Bounce or Heed the Warnings?

This is not an “investment” decision but a high-stakes speculative trade.

The Overwhelmingly Bearish Case (Why to Stay Away):

-

The Fade Pattern: The intraday action is a classic bearish reversal pattern.

-

Catastrophic Long-Term Trend: You would be betting against a stock that has lost 97% of its value. The trend is strongly against you.

-

Proximity to Breakdown: A break below the 52-week low of $3.05 could trigger another wave of panic selling from the few remaining long-term holders.

The Contrarian “Lottery Ticket” Case (The Extremely High-Risk Play):

-

The Bounce Play: The only potential bullish argument is a technical one. Some traders might gamble on a short-term bounce if the stock successfully defends its 52-week low of $3.05. This is a “knife-catching” strategy that requires impeccable timing and strict risk controls.

-

The News Catalyst: The initial gap up was caused by something. If that news is genuinely transformative (which is highly unlikely given the subsequent fade), there could be another attempt to rally.

What a Trader MUST Do Before Acting:

-

Find the Catalyst: You must find the press release or news that caused the morning gap up. Is it significant, or was it minor news that created a temporary hype bubble?

-

Watch Level II and Volume: Is the selling volume overwhelming the buying volume? This will confirm the weakness of the stock.

-

Employ Iron-Clad Risk Management: If you even consider trading this, you must use a tight stop-loss below the daily low and only risk capital you are fully prepared to lose.

The Alzamend Neuro stock is a textbook example of a high-risk, speculative security. While the ticker shows a green number for the day, the underlying technical action is weak and the long-term trend is disastrous. The stock is precariously close to its 52-week low, making a breakdown a significant risk. This is a trading vehicle suitable only for the most experienced, risk-tolerant speculators. For the vast majority of investors and traders, the numerous red flags suggest that the safest course of action is to avoid it entirely.