Allarity Therapeutics Stock Nears Yearly Low: A Trader’s High-Risk Analysis

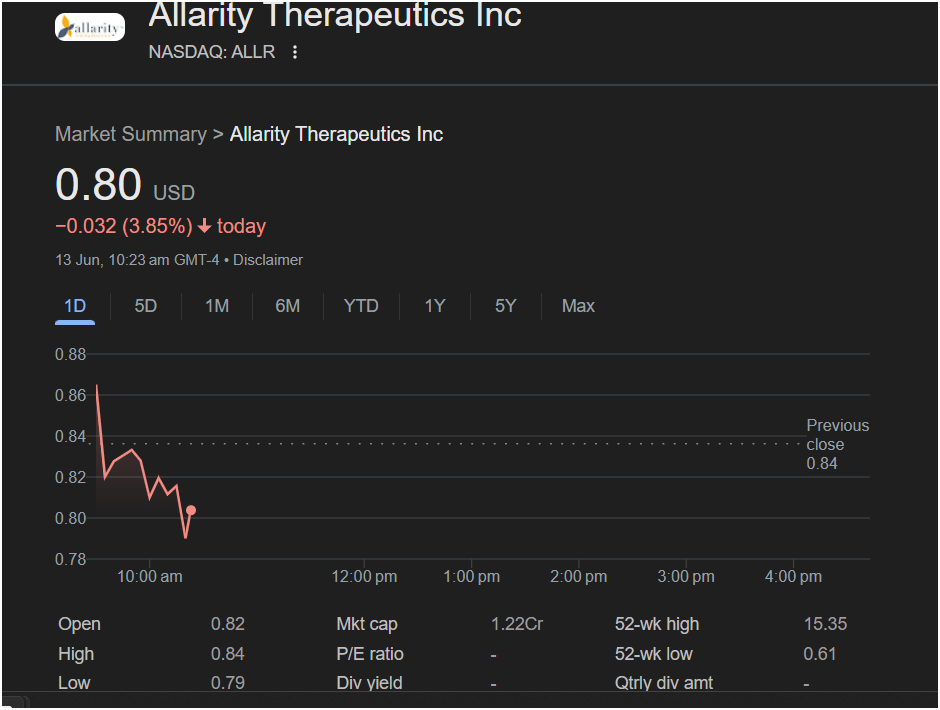

The Allarity Therapeutics stock (NASDAQ: ALLR) is continuing its sharp descent today, dropping nearly 4% in early trading and pushing it dangerously close to its 52-week low. For traders, this scenario represents a critical moment for a highly speculative stock. This analysis, based on a market snapshot from June 13th at 10:23 AM GMT-4, will dissect all the available information to highlight the immense risks and potential speculative plays involved.

Extreme Risk Warning: This article analyzes a nano-cap “penny stock” that is unprofitable and in a severe long-term downtrend. The risk of a sudden and complete loss of capital is exceptionally high. This information is for educational purposes only and is not a recommendation to buy or sell. Trading stocks like ALLR is extremely speculative.

Part 1: The Intraday Picture – A Continuation of the Downtrend

The immediate data for Allarity Therapeutics shows a clear continuation of negative sentiment.

-

Current Price: 0.80 USD

-

Today’s Change: Down -0.032 (-3.85%)

-

Market Sentiment: Strongly bearish, as indicated by the significant percentage drop.

The 1-day chart illustrates a pattern of weakness:

-

The Open: The stock opened at 0.82, below the previous close of 0.84.

-

The Rejection: It attempted a small rally to touch the previous day’s close of 0.84 but was firmly rejected, which is a bearish technical signal.

-

The New Low: Sellers then pushed the price down to a new daily low of 0.79. The current price of 0.80 is a slight bounce off this low.

Trader’s Takeaway: The immediate momentum is negative. The failure to reclaim the previous day’s close confirms that sellers are in control. The most critical level to watch now is the 52-week low of 0.61. The daily low of 0.79 is the first line of defense, but a break below it could quickly lead to a test of that yearly low.

Trader’s Takeaway: The immediate momentum is negative. The failure to reclaim the previous day’s close confirms that sellers are in control. The most critical level to watch now is the 52-week low of 0.61. The daily low of 0.79 is the first line of defense, but a break below it could quickly lead to a test of that yearly low.

Part 2: The Fundamental Context – Unpacking the Extreme Risk Profile

The financial metrics (or lack thereof) are crucial to understanding why this stock is so risky.

-

Market Cap (1.22Cr): This indicates a market capitalization of approximately $12.2 million. This is a nano-cap stock. These stocks are characterized by:

-

Extreme Volatility: Tiny buy or sell orders can cause massive price swings.

-

Low Liquidity: It can be very difficult to sell your shares, especially if the price is falling fast.

-

“Penny Stock” Status: Trading under $1 per share, it falls into the category of a penny stock, which comes with a high risk of manipulation and delisting.

-

-

P/E Ratio (-): The absence of a P/E ratio means Allarity Therapeutics is not profitable. Its value is not based on current earnings but solely on speculation about its future potential.

-

52-Week Range (0.61 – 15.35): This is the most alarming piece of data. The stock has collapsed from over $15 to its current price of $0.80 in the past year. This represents a catastrophic loss of value and signals a powerful, long-term downtrend, likely due to fundamental issues like poor clinical trial results or financing problems.

-

Dividend Yield (-): As expected for an unprofitable development-stage biotech company, it pays no dividend.

Part 3: The Speculator’s Dilemma – Invest, Avoid, or Gamble?

The term “invest” is inappropriate here; this is pure speculation.

The Overwhelmingly Bearish Case (The Reasons to Avoid):

-

The Trend is Catastrophic: The stock is in a massive, year-long downtrend. Betting against such a strong trend is a low-probability trade.

-

No Fundamental Support: With no profits, the stock has no valuation floor. Its price is based on sentiment, which is currently very negative.

-

Proximity to 52-Week Low: A break of the $0.61 yearly low would be a major bearish event, potentially triggering another wave of panic selling as remaining investors capitulate.

The Contrarian “Lottery Ticket” Case (The Extremely High-Risk Play):

-

“Bottom Fishing”: Some speculators may attempt to trade a short-term bounce if the stock hits or successfully defends its 52-week low. This is akin to catching a falling knife and requires perfect timing and strict risk management.

-

News-Driven Spike Potential: Because the stock price is so low, any piece of unexpected positive news (e.g., a partnership, positive trial data) could cause a massive percentage spike. This is a gamble on an unknown future event.

What a Speculator MUST Investigate:

-

The News Flow: Why has the stock collapsed? Are there recent SEC filings (like for a share offering, which is dilutive) or press releases about its drug candidates?

-

Cash Burn Rate: How much cash does the company have and how quickly is it spending it? Nano-cap biotechs are in a constant race against time before they need to raise more money, often by selling more stock and diluting existing shareholders.

The Allarity Therapeutics stock is a high-risk, speculative instrument that is unsuitable for the vast majority of investors. The data points to a company in a severe, long-term decline that is now testing its yearly lows. The probability of further losses is substantially higher than that of a sustained recovery.

Only the most experienced, risk-tolerant traders should even contemplate this stock, and only for a short-term, speculative bounce play with capital they are fully prepared to lose. For everyone else, this is a clear situation to observe from the sidelines.