Of course. Here is a detailed news article analyzing the provided screenshot of IBM’s stock performance, tailored for a US trader audience.

IBM Stock Hits 52-Week High Then Sells Off: What Traders Should Watch on Monday

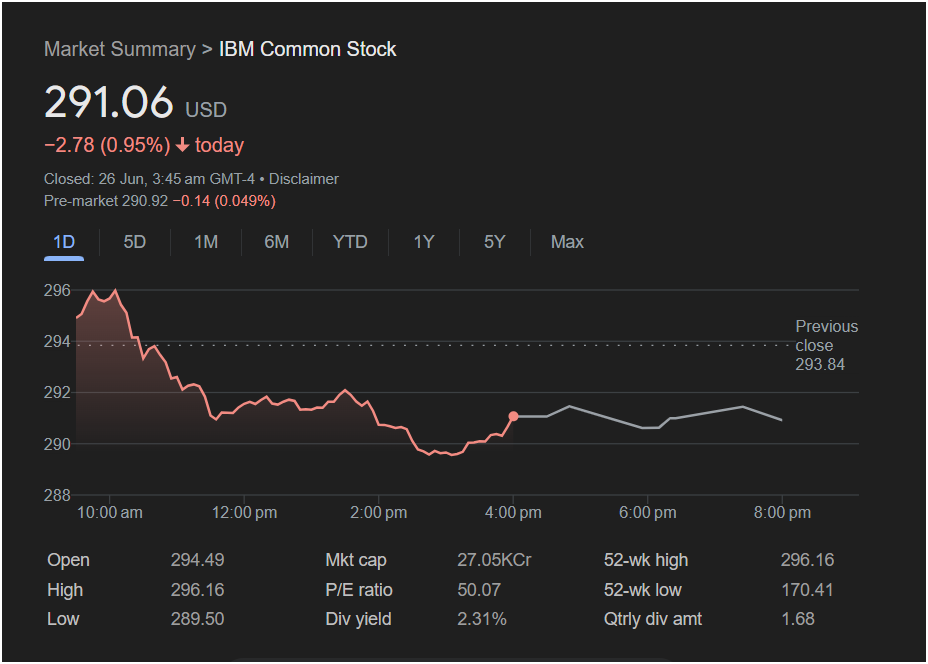

International Business Machines Corp. (IBM) stock gave investors a roller-coaster ride in its last trading session, touching a new 52-week high before succumbing to selling pressure. The tech stalwart closed the day at

2.78 (0.95%). This bearish reversal pattern at a key milestone has created uncertainty heading into the new trading week.

Adding to the cautious sentiment, pre-market data shows the stock slightly lower at

0.14 (0.049%). This analysis breaks down the essential data from the chart to help traders prepare for what could be a pivotal Monday for IBM stock.

Analyzing the Intraday Reversal

The 1-day chart for IBM shows a classic example of a failed breakout, a pattern that traders watch closely.

-

A Bullish Start: The stock opened at $294.49, above its previous close of

296.16**.

-

Rejection at the Top: This peak acted as a firm ceiling. Sellers immediately emerged, driving the price down sharply throughout the morning.

-

Finding a Low: The decline continued until the stock hit a daily low of $289.50. It then spent the rest of the afternoon consolidating well below its opening price, indicating that the sellers remained in control.

Hitting a new high and then closing near the session’s low is a significant bearish signal, suggesting that the upward momentum has stalled and profit-takers have taken over.

Key Levels for Monday’s Trading Session

The outcome of this bearish daily candle will be tested on Monday. Here are the critical price points to monitor:

-

The Key Resistance: The 52-week high of $296.16 is now the most important resistance level. The stock’s inability to hold above this price is a major red flag for bulls. Any renewed attempt to break out would need to decisively clear this hurdle.

-

Immediate Support: The day’s low of $289.50 is the first line of defense for the stock. If IBM’s price falls below this level, it could confirm the bearish reversal and potentially lead to a deeper pullback.

-

For the Income Investor: It’s important to note IBM’s attractive dividend yield of 2.31%. This feature often provides a floor of support for the stock, as income-focused investors may see price drops as an opportunity to buy.

Should You Invest in IBM Stock Now?

The decision to invest depends on your time horizon and trading style.

-

The Bearish Case (Short-Term): The technical picture from the last session is negative. The reversal from the 52-week high suggests the stock may need to pull back or consolidate before attempting another move up. The slightly negative pre-market action supports this cautious view.

-

The Bullish Case (Long-Term): IBM is a blue-chip, large-cap company that has shown significant strength, rising from a 52-week low of $170.41. The high P/E ratio of 50.07 indicates market optimism about its future. For long-term investors, especially those seeking dividends, this pullback could present a more attractive entry point.

IBM stock faces a critical test on Monday. The bearish reversal from its 52-week high suggests short-term weakness, but the company’s long-term appeal and dividend yield could limit the downside. Traders should watch the key levels of

289.50 (support) closely. The market’s reaction at these points will provide the best clue as to whether the stock is poised for a further decline or is simply gathering strength for its next leg up.

Disclaimer: This article is for informational purposes only and is based on the analysis of the provided image. It does not constitute financial advice. All investing involves risk, and you should conduct your own research or consult with a qualified financial professional before making any investment decisions.