Mastercard’s Rollercoaster Ride: Why a 0.00% Change Hides a Day of Fierce Trading

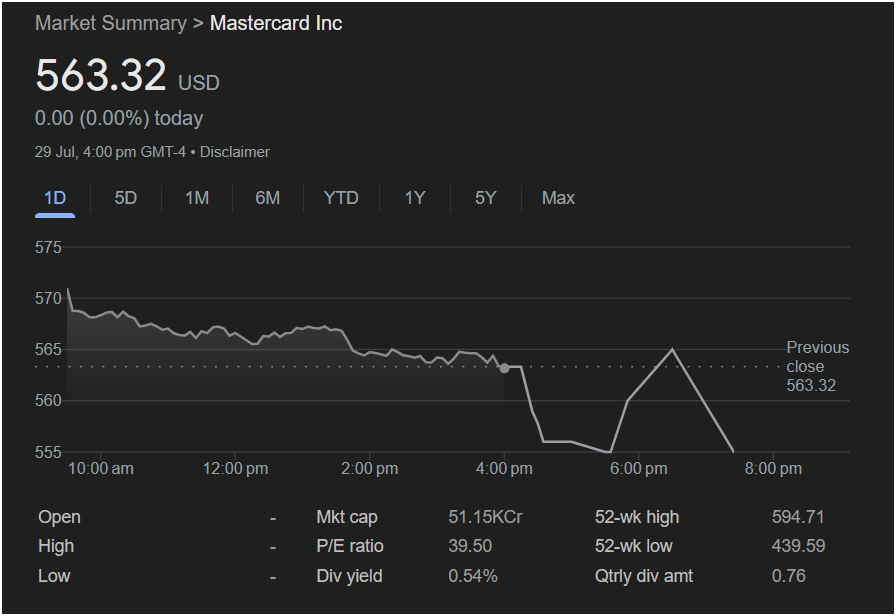

NEW YORK – On the surface, it was a day of perfect stillness for Mastercard Inc. (NYSE: MA). As the final bell echoed through the halls of the New York Stock Exchange, the payments titan’s stock price settled at $563.32—precisely where it began. The official record shows a change of $0.00, a clean 0.00% move. But for traders and investors who watched the stock throughout the day, that flat finish masks a turbulent story of intraday volatility, a dramatic late-session plunge, and a powerful recovery, painting a vivid picture of the market’s ongoing tug-of-war.

The day’s trading action for Mastercard was a classic case of the final score not reflecting the intensity of the game. The session began with the stock trading near the $570 mark, showing initial strength. However, through the morning and into the early afternoon, a persistent, grinding pressure pushed the price steadily lower. By 2:00 PM, it had breached the $565 level, signaling that sellers were firmly in control for most of the standard trading hours.

The real drama, however, unfolded around the 4:00 PM market close. In a sudden and sharp move, the stock price plunged, falling to an intraday low near $555. This kind of late-day drop can often be attributed to large block trades or programmatic selling hitting the market. For a brief period, it appeared Mastercard was destined to end the day significantly in the red.

Yet, in a testament to the underlying strength and investor interest in the company, a powerful wave of buying pressure emerged in the post-market session. The stock didn’t just stabilize; it staged a remarkable V-shaped recovery, clawing back every dollar it had lost in the final hours. This aggressive rebound culminated in the stock landing exactly on its previous closing price of $563.32, a rare feat that signifies a market in perfect, albeit hard-fought, equilibrium.

Beyond the Flatline: A Deeper Look at the Numbers

Beyond the Flatline: A Deeper Look at the Numbers

This volatile journey to a flat close forces a closer look at the fundamental metrics that underpin Mastercard’s valuation. Trading at $563.32, the company sits comfortably within its 52-week range, which spans from a low of $439.59 to a high of $594.71. This positioning suggests that while the stock is not at its peak, investor sentiment has remained broadly positive over the past year.

A key indicator of this sentiment is the company’s Price-to-Earnings (P/E) ratio, which stands at a robust 39.50. This figure, significantly higher than the average for the broader S&P 500, indicates that investors are willing to pay a premium for Mastercard’s shares. They are betting on the company’s future growth prospects, its dominant position in the global payments ecosystem, and its ability to continue innovating in areas like digital payments, cybersecurity, and data analytics. This high P/E is characteristic of a blue-chip growth stock that consistently delivers strong earnings.

While primarily a growth-oriented investment, Mastercard also provides a modest return to shareholders through dividends. With a dividend yield of 0.54% and a quarterly dividend amount of $0.76 per share, it offers a small but steady income stream. This reflects a balanced capital allocation strategy, where the company reinvests the majority of its profits back into the business to fuel further expansion while still rewarding long-term investors.

The sheer scale of the company is reflected in its market capitalization, which the provided data from a localized service lists as 51.15KCr. For context in the U.S. market, this represents a valuation well into the hundreds of billions of dollars, cementing Mastercard’s status as one of the world’s most valuable financial services companies.

A Barometer for the Global Consumer

The daily fluctuations of Mastercard’s stock are watched by more than just its investors; they are seen as a real-time indicator of global consumer health. As a central pillar of the world’s payment infrastructure, Mastercard’s revenue is directly tied to transaction volumes. When consumers are confident and spending, Mastercard thrives. When economic uncertainty looms, a slowdown in spending can impact its bottom line.

Therefore, the intraday battle between buyers and sellers could be interpreted as a microcosm of the larger economic debate. The downward pressure during the day may reflect concerns about persistent inflation, interest rate policies from the Federal Reserve, or geopolitical tensions. Conversely, the powerful recovery to end the day unchanged suggests a resilient base of investors who believe in the long-term trend of digitization and the secular shift away from cash.

This places Mastercard at the center of a dynamic and competitive landscape. It faces constant competition from its primary rival, Visa, as well as from other established players like American Express. Furthermore, the rise of fintech disruptors, including PayPal, Block (formerly Square), and a new generation of Buy Now, Pay Later (BNPL) services, continues to reshape the payments industry. The day’s trading activity shows that investors are continuously reassessing Mastercard’s ability to navigate these challenges and maintain its formidable market share.

As the markets prepare for the next session, the story of Mastercard’s wild ride to nowhere leaves traders with a critical question. Was this day of high-volume, high-volatility trading that ended in a stalemate a sign of a market consolidating before its next major move, or does it represent a fundamental indecision about the economic path ahead? The battle for control over Mastercard’s stock, and by extension the narrative of the global consumer, remains intensely undecided.