Salesforce Stock Jumps But Fades from Highs: What Traders Need to Watch Monday

Salesforce Inc. (NYSE: CRM) closed Wednesday with a respectable gain, but the intraday price action tells a more complex story of a battle between buyers and sellers that traders must watch closely heading into next week.

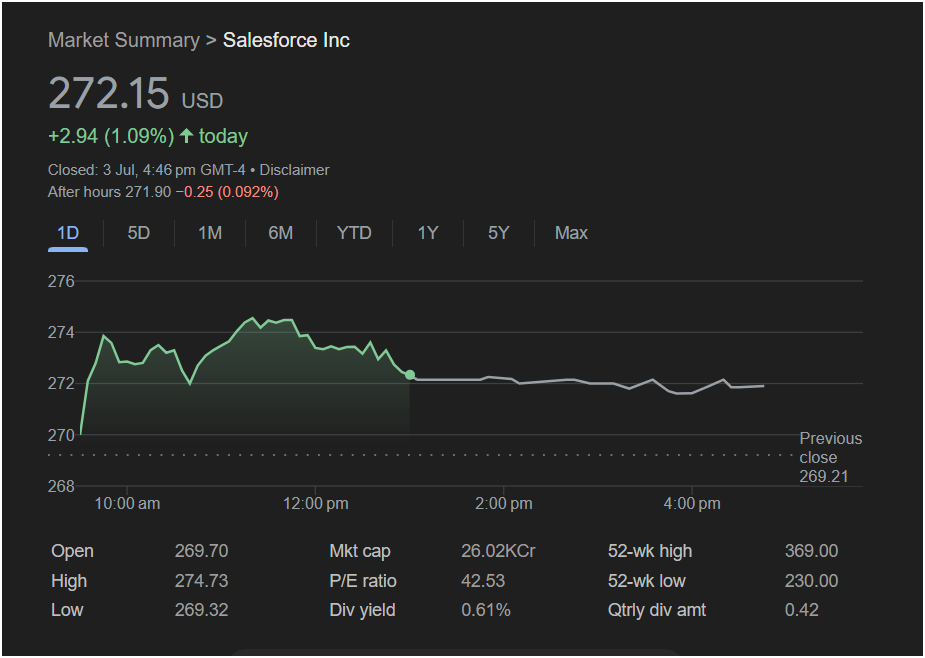

The cloud software giant finished the session at

2.94 (1.09%). However, a slight dip in after-hours trading to $271.90 capped a day where the stock failed to hold its initial powerful rally, offering a note of caution for Monday’s open.

A Trader’s Recap of the Day’s Action

Wednesday’s session for Salesforce was a tale of two halves. The stock opened at $269.70, gapping up from the previous close of

274.73**.

At this peak, however, sellers emerged. For the remainder of the day, Salesforce stock entered a slow but steady decline, giving back more than half of its intraday gains before closing at $272.15. This pattern, often called “selling into strength” or a “fading rally,” is a potential red flag. It indicates that while buyers were enthusiastic early on, sellers were more than happy to take profits and were in control for the majority of the trading day.

Key Financial Metrics to Consider

A full analysis requires looking at the fundamental context, which is particularly important for a stock like Salesforce:

-

Valuation (P/E Ratio): With a P/E ratio of 42.53, Salesforce commands a premium valuation typical of a market leader in the software-as-a-service (SaaS) space.

-

52-Week Range: This is a crucial piece of context. The current price of

369.00** and is much closer to the 52-week low of $230.00. This suggests the stock has been in a period of underperformance, and Wednesday’s gain is a bounce within a larger consolidation or downtrend, not a breakout attempt.

-

Dividend: Salesforce recently initiated a dividend, currently at $0.42 quarterly, yielding 0.61%. This is a sign of the company’s maturity and commitment to returning capital to shareholders.

Outlook for Monday: A Test of Strength

Given the fading action on Wednesday, the outlook for Salesforce stock on Monday is mixed and cautious. The intraday weakness suggests potential for a further pullback unless buyers can reassert control.

Traders should watch two critical levels at the open:

-

Bearish Scenario: The most immediate risk is a continuation of the fade. If the stock breaks below the day’s low of $269.32 and the previous close of $269.21, it would confirm that sellers remain in control, potentially leading to a further decline.

-

Bullish Scenario: For bulls to regain momentum, they need to push the stock back up and decisively reclaim the day’s high of $274.73. A move above this level would invalidate the afternoon fade and could signal that the bounce has more room to run.

Conclusion: Is It Right to Invest Today?

The current chart for Salesforce suggests caution is warranted.

For short-term traders, the fade from the highs is a warning sign. This is not a clear-cut entry point. It would be prudent to wait for the market to choose a direction on Monday—either by breaking above the $274.73 resistance or falling below the $269.32 support.

For long-term investors, the picture is different. The stock is well off its highs, which could present a buying opportunity for those who believe in the company’s long-term growth story and feel it is undervalued after its recent slide. However, the premium P/E ratio and recent price weakness mean any investment should be made with a clear understanding of the risks.

Disclaimer: This article is for informational purposes only and is based on an analysis of the provided image. It should not be considered financial advice. All stock market investments carry risk, and you should conduct your own research or consult with a qualified financial advisor before making any investment decisions.