General Electric Stock Surges 1.48%: Is Now the Time to Invest in GE

General Electric stock (GE) showed significant strength on Monday, June 20, rallying impressively and closing with a solid gain. The industrial conglomerate’s positive performance, which it held throughout the session, gives bullish investors a reason for optimism and raises the question of whether this upward momentum can be sustained.

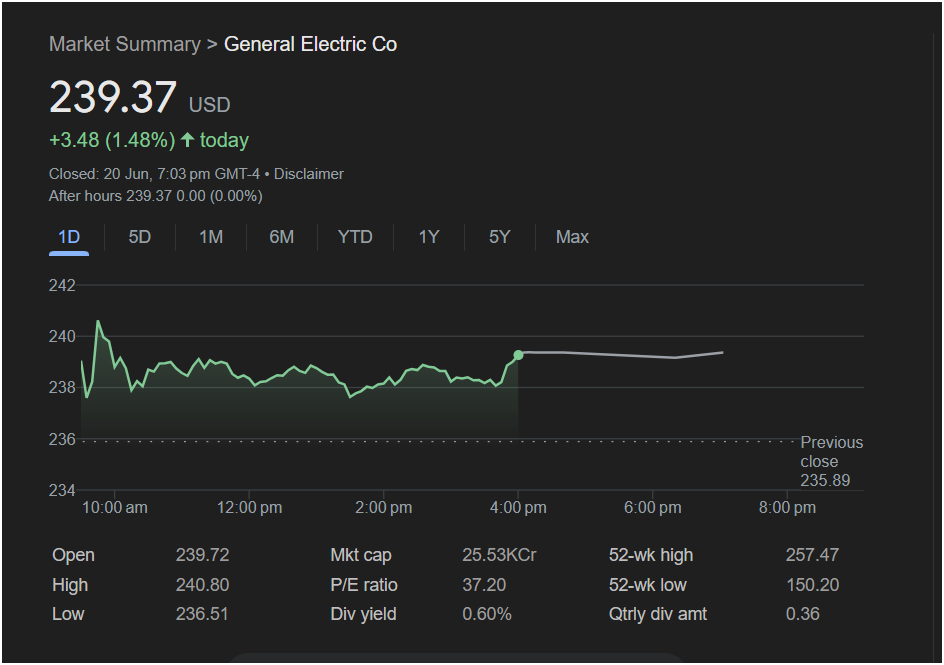

General Electric Co closed the main trading session at 239.37 USD, up a healthy $3.48 (1.48%). After-hours trading was flat, holding at 239.37, suggesting the stock is consolidating its gains rather than giving them back.

A Breakdown of Monday’s Bullish Session

The 1-day chart for GE paints a picture of controlled strength from the opening bell to the close.

-

Gap-Up and Go: The stock started the day strong, opening at $239.72, well above the previous close of

240.80**.

-

Strong Support: While the stock pulled back from its high, it found strong buying interest. Crucially, the day’s low of $236.51 remained comfortably above the previous day’s close, a very bullish sign indicating that buyers were in firm control.

-

Consolidation and Strong Close: For most of the day, GE traded in a stable range, absorbing any selling pressure before closing near its opening price. This shows that the initial bullish move was not a fluke and was well-supported throughout the session.

Holding the gains from a gap-up opening for an entire day is a clear signal of positive market sentiment for the stock.

Key Metrics for a GE Trader

To get a full view, here are the essential data points from Monday’s trading activity:

-

Open: 239.72

-

High: 240.80

-

Low: 236.51

-

Previous Close: 235.89

-

Market Cap: 25.53KCr

-

P/E Ratio: 37.20

-

52-Week Range: The current price is trading much closer to its 52-week high of $257.47 than its low of $150.20, placing it in the upper end of its yearly performance.

-

Dividend Yield: 0.60%

Is it a Good Time to Invest in General Electric?

Based on Monday’s decisive price action, the outlook appears positive.

The Bullish Case: The evidence for further upside is compelling. The stock not only gapped up but also established a higher low and closed strong. This “gap and hold” pattern is technically bullish and often precedes further gains. The flat after-hours session suggests a healthy consolidation before a potential next move.

The Bearish Case: The only minor point of caution is that the stock failed to break through the day’s high of $240.80. This level now serves as the immediate point of resistance. Bulls will need to see the price push conclusively through this barrier to confirm the next leg of the rally.

Conclusion and Trading Outlook:

The momentum for General Electric stock is undeniably bullish.

-

An aggressive trader might see the current level as an opportunity to invest, using the day’s low of $236.51 as a key support level to watch. As long as the stock holds above this, the outlook remains positive.

-

A more conservative strategy would be to wait for a confirmed breakout above the $240.80 resistance level before committing capital.

Monday’s performance has put GE on the radar for many traders. The stock has shown fundamental strength, and if it can overcome its minor intraday resistance, it could be poised for further gains.

Disclaimer: This article is for informational purposes only and is not financial advice. All investment decisions should be made with the help of a qualified financial professional.