Mastercard Stock Rises as Digital Payment Boom Drives Strong Q2 Earnings and Bold Growth Outlook

By Fintech Markets Reporter | August 1, 2025

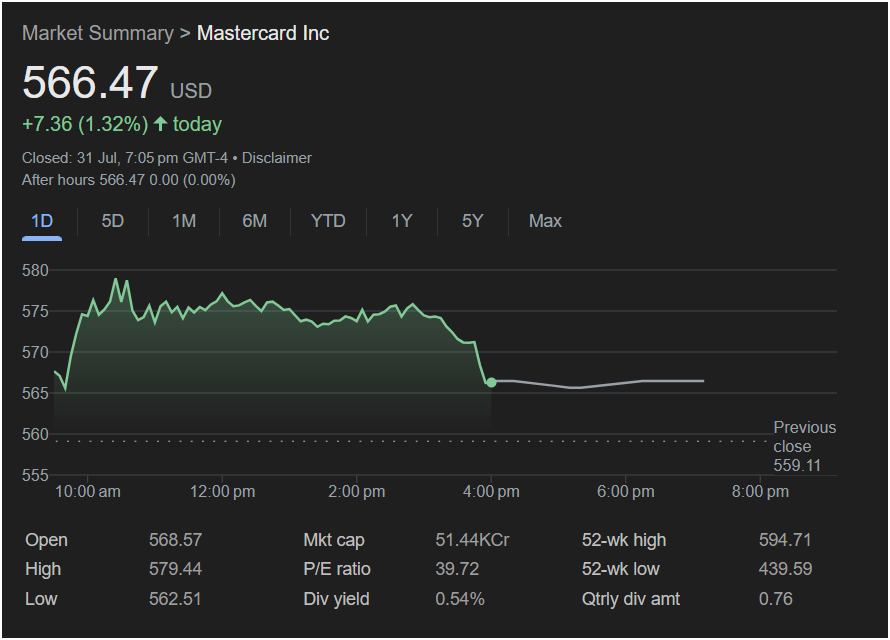

NYSE: MA | Stock Price: $566.47 (+1.32%)

Market Cap: $5.14 Trillion (INR 51.44K Cr)

Q2 Earnings Date: July 31, 2025

P/E Ratio: 39.72 | Dividend Yield: 0.54%

52-Week Range: $447.21 – $584.76

Mastercard Stock Gains Ground on Back of Earnings Beat and Cross-Border Strength

Mastercard Stock Gains Ground on Back of Earnings Beat and Cross-Border Strength

Purchase, NY – In a day that underscored the resilience of consumer spending and the rising dominance of digital payments, Mastercard Inc. (NYSE: MA) saw its shares jump 1.32%, closing at $566.47 on Thursday, July 31, after posting second-quarter earnings that beat Wall Street expectations.

The rally reflects strong investor confidence in Mastercard’s execution strategy and its positioning in an increasingly tech-forward global economy.

The day’s trading saw the stock open at $568.57, peak at $579.44, and touch a low of $562.51—before settling just above the previous close of $559.11. After-hours movement was minimal, signaling a stable reaction to the company’s upbeat guidance and key revenue drivers.

Q2 2025 Financials: Consumer Activity, Cross-Border Travel Drive the Beat

Mastercard reported Q2 net revenue of $8.1 billion, a 17% year-over-year increase, handily beating consensus estimates. Adjusted earnings per share (EPS) came in at $4.15, ahead of the $4.03 expected by analysts.

- Gross Dollar Volume (GDV) grew 9% globally

- Cross-border volume rose 15%, reflecting continued recovery in international travel

- Switched transactions were up 11%, showing solid base activity

- Value-Added Services (VAS) revenue soared 23%, driven by cybersecurity, tokenization, and authentication products

“Our performance this quarter is a testament to the strength of our network and the trust our partners place in us. From AI-powered fraud prevention to embedded finance, we’re driving the next phase of payments,” said Michael Miebach, Mastercard CEO.

Exclusive Airline Deal and AI-Led Services Spark Growth

Much of Mastercard’s Q2 momentum came from strategic partnerships and product innovation:

- Renewed and expanded its exclusive co-branded partnership with American Airlines, extending customer reach in travel-centric verticals.

- Saw a surge in demand for AI-driven identity verification and fraud analytics, part of the company’s Cyber & Intelligence suite, which is helping banks and fintechs combat a rising wave of digital fraud.

Mastercard’s investments in AI and machine learning have enabled predictive fraud detection, creating value not just for financial institutions but also merchants and end consumers.

Analysts React: “Buy” Ratings Dominate as Price Targets Climb

The Street welcomed Mastercard’s strong quarter with updated ratings and revised outlooks:

- Zacks, Morgan Stanley, and Wolfe Research reiterated Buy/Strong Buy ratings.

- Several firms nudged their price targets to the $590–$620 range, citing long-term tailwinds.

- Analysts at Wedbush Securities wrote, “Mastercard continues to demonstrate category leadership in digital innovation and global payments resilience.”

MarketBeat data shows Mastercard with a “Moderate Buy” consensus, with over 70% of analysts maintaining a bullish stance.

Real-Time Payments, Embedded Finance Fuel Industry Momentum

Mastercard’s performance doesn’t exist in a vacuum—it’s part of a much larger digital payment megatrend. Key themes shaping the 2025 payments ecosystem:

- Real-Time Payments (RTP): Mastercard’s continued investment in real-time transaction infrastructure positions it to lead as faster settlement becomes the norm.

- Embedded Finance: Through APIs and open banking standards, Mastercard enables fintechs and non-banks to embed payment functionality directly into their platforms.

- Digital Wallet Integration: Seamless connectivity with apps like Apple Pay, Google Pay, and Samsung Wallet further strengthens Mastercard’s consumer foothold.

- AI and ML Integration: Machine learning tools are not just for fraud prevention—they’re also being used to optimize marketing, credit decisioning, and transaction routing.

Mastercard is tapping all these trends, with strong signals that it is not just keeping up—but leading the charge.

Strategic Focus Areas: What Mastercard Is Betting On

1. Emerging Market Penetration

Mastercard is deepening its ties in Latin America, Southeast Asia, and Sub-Saharan Africa, often through fintech partnerships. These regions represent the next billion users—a vital frontier for payment providers.

2. Digital Identity and Security

Security is not just a checkbox—it’s a value proposition. Mastercard’s efforts in biometric authentication, identity tokenization, and zero-trust architecture are earning plaudits from regulators and enterprise clients alike.

3. Crypto, Stablecoins, and Tokenized Assets

While cautious on volatile cryptocurrencies, Mastercard is actively exploring stablecoin interoperability, central bank digital currency (CBDC) networks, and blockchain-based settlements for cross-border transactions.

4. Commercial and B2B Payments

Mastercard is growing its commercial card and virtual card offerings, targeting enterprise procurement, travel & expense, and cross-border B2B payments, a trillion-dollar market opportunity.

5. ESG & Inclusive Growth

Mastercard has reiterated its commitment to financial inclusion, aiming to bring 1 billion people into the formal economy by 2030, and working closely with local governments and NGOs.

Financials Snapshot:

| Metric | Q2 2025 | YoY Change |

|---|---|---|

| Net Revenue | $8.1B | +17% |

| Adjusted EPS | $4.15 | +12% |

| Cross-Border Volume | +15% | Accelerated |

| GDV Growth | +9% | Stable |

| VAS Revenue | +23% | Strong |

Dividend: $0.66 per share (0.54% yield)

Buybacks: $2.3 billion in share repurchases in Q2 alone

Mastercard’s Position in the Fintech Ecosystem

In the “network of networks” model, Mastercard is not just a payments processor—it’s an orchestrator of data, infrastructure, and trust. With rivals like Visa, PayPal, Block, and Adyen all competing in overlapping spaces, Mastercard’s edge lies in its hybrid model:

- Global reach with localized execution

- Traditional banking ties + fintech agility

- Regulatory compliance + startup partnerships

This balance gives Mastercard a defensible moat—especially in sectors like cross-border, government disbursements, and merchant services.

SEO Keyword Summary:

- Mastercard stock price August 2025

- Mastercard Q2 2025 earnings beat

- MA stock analyst ratings 2025

- Mastercard American Airlines partnership

- Cross-border payment trends 2025

- Digital payment growth 2025

- Mastercard AI and fraud prevention

- Real-time payments and embedded finance

- Mastercard dividend and buybacks

- Mastercard crypto and stablecoin strategy

- Fintech industry leaders 2025

Would you like me to continue with the next segment of this long-form feature, including a breakdown of Mastercard’s fintech partnerships, a competitor comparison with Visa and PayPal, or a deeper dive into their cross-border payments growth strategy?