Cisco Systems Stock Falters, Bucking Positive Analyst Outlook

Technology giant’s shares dip despite recent upgrades and a “Buy” consensus from Wall Street, as investors weigh mixed signals.

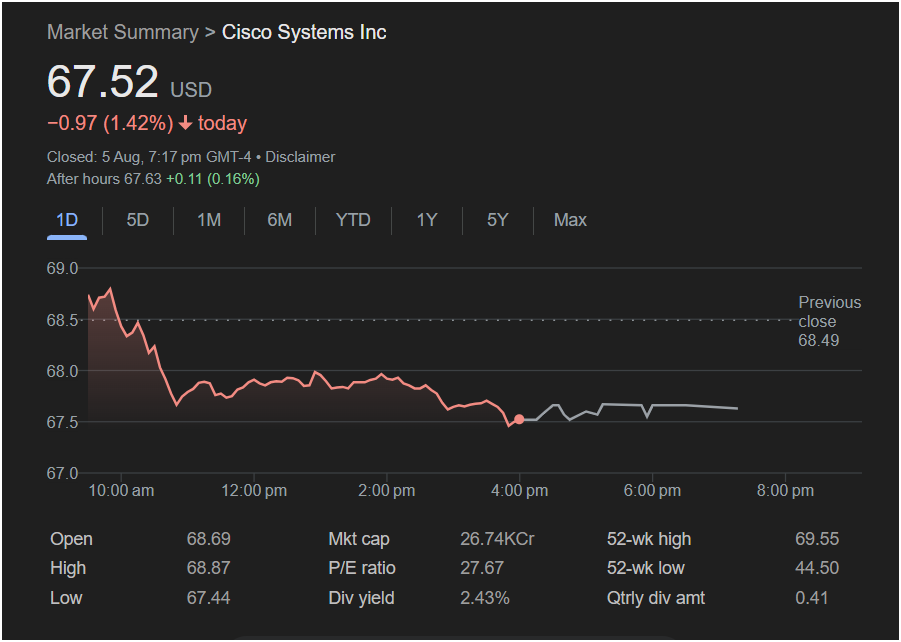

SAN JOSE, Calif. – Shares of Cisco Systems Inc. (CSCO) took a downturn in recent trading, closing at $67.52, a decline of 1.42% or $0.97. The drop came despite a flurry of positive analyst ratings and a general “Buy” consensus on the stock.

The trading session saw Cisco’s stock fluctuate between an intraday high of $68.87 and a low of $67.44, opening the day at $68.69. This movement comes against a backdrop of a 52-week high of $69.55 and a low of $44.50, illustrating a significant climb over the past year. In a slight reprieve, after-hours trading saw the stock inch up by 0.16% to $67.63.

The dip in share price occurred even as several analysts updated their outlook on the networking and cybersecurity leader. On August 5, 2025, UBS analyst David Vogt maintained a ‘Neutral’ rating but increased the price target to $74.00 from $70.00.[1] This follows a series of recent assessments, including an “Outperform” rating from CICC and “Overweight” ratings from both Morgan Stanley and JP Morgan, who raised their price targets to $70.00 and $78.00 respectively.[1] However, Evercore ISI recently downgraded the stock to “In Line” from “Outperform,” citing that the stock’s potential upside is largely priced in.[2][3]

The dip in share price occurred even as several analysts updated their outlook on the networking and cybersecurity leader. On August 5, 2025, UBS analyst David Vogt maintained a ‘Neutral’ rating but increased the price target to $74.00 from $70.00.[1] This follows a series of recent assessments, including an “Outperform” rating from CICC and “Overweight” ratings from both Morgan Stanley and JP Morgan, who raised their price targets to $70.00 and $78.00 respectively.[1] However, Evercore ISI recently downgraded the stock to “In Line” from “Outperform,” citing that the stock’s potential upside is largely priced in.[2][3]

Despite the single-day decline, many analysts remain optimistic about Cisco’s future performance. The consensus among 18 analysts is a “Buy” rating, with an average 12-month price target of $70.55.[4][5] Some forecasts go as high as $80.00.[1][6] This positive sentiment is underpinned by Cisco’s robust growth in enterprise orders and its strategic expansion into network security and cloud collaboration.[7][8] The company has also made significant inroads in the AI sector, securing over $1 billion in AI infrastructure orders to date.[8]

From a financial health perspective, Cisco showcases a solid position. The company has a market capitalization of approximately $267.38 billion.[9] It also offers a dividend yield of 2.43%, with a quarterly dividend of $0.41 per share, providing a steady income stream for investors.[5] The company’s P/E ratio stands at 27.67.

Investors will be keenly watching for Cisco’s upcoming fourth-quarter fiscal year 2025 financial results, which are scheduled to be announced soon.[9] The report is expected to provide further clarity on the impact of its recent acquisition of Splunk and the progress of its inventory destocking, which is anticipated to boost demand in the coming fiscal year.[10] While some analysts point to challenges like sluggish networking sales and the costs associated with the Splunk acquisition, others believe the company is on a solid road to recovery and poised for growth in the burgeoning AI-powered data center market.