Tesla Stock Forecast: After a Sharp 7% Drop, Will TSLA Rebound on Monday

Tesla Inc. (TSLA) stock closed the week on a significantly bearish note, leaving investors and traders on edge. However, a glimmer of hope emerged in pre-market activity, setting the stage for a potentially volatile and critical trading session on Monday. For traders looking to make a move, understanding Friday’s action and the signals for the week ahead is paramount.

Friday’s Trading Session: A Detailed Breakdown

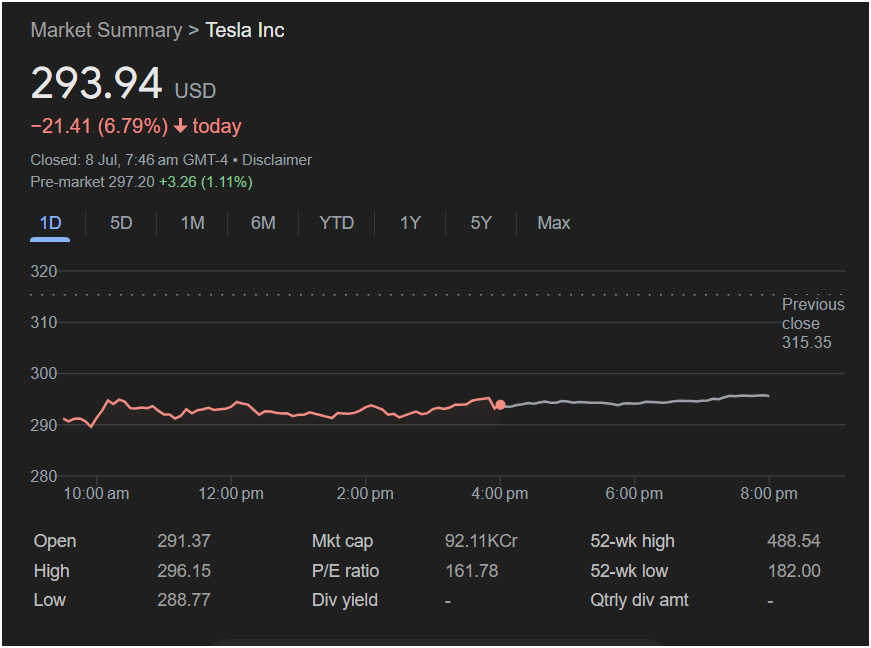

A look at the market summary for Friday, July 8th, paints a clear picture of a stock under heavy selling pressure.

-

Steep Decline: Tesla closed at 293.94 USD, marking a substantial loss of -21.41, or -6.79% for the day. This sharp drop indicates strong bearish sentiment throughout the trading session.

-

Gap Down Opening: The stock opened at 291.37, well below the previous day’s close of 315.35. This immediate gap down at the open set a negative tone for the entire day.

-

Intraday Volatility: Throughout the day, the stock traded within a range, hitting a high of 296.15 and a low of 288.77. While it recovered from its lowest point, it failed to reclaim any significant ground, struggling to stay above the 295 mark.

The Bullish Signal: Pre-Market Rebound Offers Hope

The Bullish Signal: Pre-Market Rebound Offers Hope

Despite the punishing regular session, the after-hours and pre-market data provides a counter-narrative. The screenshot shows pre-market trading at 297.20, an increase of +3.26 (1.11%).

This positive pre-market activity is a crucial indicator for traders. It suggests that sentiment may be shifting, and “buy-the-dip” investors could be stepping in to purchase shares at what they perceive to be a discounted price following Friday’s sell-off. This could lead to a stronger opening on Monday.

Key Financial Metrics for Traders

To make an informed decision, every trader needs to consider the stock’s vital statistics:

-

Closing Price (Jul 8): 293.94 USD

-

Previous Close: 315.35 USD

-

Day’s Range: 288.77 (Low) – 296.15 (High)

-

52-Week Range: 182.00 (Low) – 488.54 (High)

-

Market Cap: 92.11KCr (approximately $921.1 Billion)

-

P/E Ratio: 161.78

-

Dividend Yield: None

The current price is positioned roughly in the middle of its 52-week range, indicating it is far from its peak but has also bounced significantly from its lows. The high P/E ratio of 161.78 confirms that Tesla is still valued as a high-growth company, meaning investors expect strong future earnings, which can also contribute to volatility.

Outlook for Monday: Is It Right to Invest?

Based on the data, Monday is shaping up to be a pivotal day for Tesla stock. Here’s how different traders might interpret the situation:

The Bullish Case (A Potential Buying Opportunity):

Traders with a higher risk appetite might see Friday’s -6.79% drop as an overreaction and a prime opportunity to enter a long position. The positive pre-market gain of over 1% supports this view, signaling a potential reversal. If the stock opens strong on Monday and breaks through resistance near the 297-300 USD level, it could confirm the start of a bounce-back.

The Cautious Case (Wait for Confirmation):

More conservative traders may want to remain on the sidelines. A single pre-market gain does not guarantee a sustained recovery. The significant drop from the previous close of 315.35 shows that there is strong downward momentum. It would be prudent to wait and see if the stock can establish a clear support level and show consistent upward movement during Monday’s session before committing capital. The key will be whether the pre-market optimism can withstand the opening bell’s market pressures.

for Traders:

Tesla stock is at a crossroads. Friday’s performance was decidedly negative, but the positive pre-market data cannot be ignored. The most likely scenario for Monday is a volatile opening.

-

Watch the open: A gap up above 297 could fuel further buying. A failure to hold these gains could see the stock re-test Friday’s lows.

-

Key Level: The psychological $300 level will act as a significant short-term resistance. A firm break above this could signal further upside.

Investing today carries both significant risk and potential reward. The decision to invest should align with your personal risk tolerance and trading strategy. Monday’s first few hours of trading will provide the most telling clues about Tesla’s direction for the week ahead.