Breaking Newsछत्तीसगढ़स्लाइडर

पुलिस विभाग में बड़ा तबादला, 3 SI समेत 14 पुलिसकर्मियों का फेरबदल… देखिए पूरी सूची…

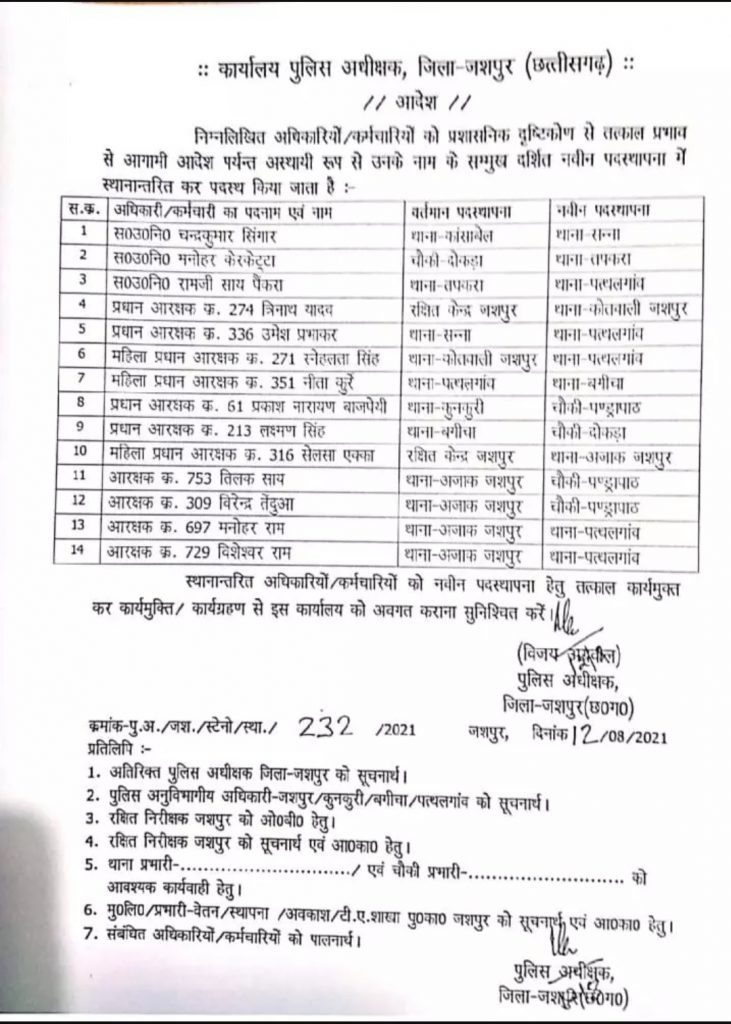

जशपुर। छत्तीसगढ़ के जशपुर जिले में एक बार फिर थानों में फेरबदल किया गया है. एसपी ने 3 उपनिरीक्षक, 7 प्रधान आरक्षक और 4 आरक्षक का तबादला किया है. कुल 14 पुलिसकर्मियों को इधर से उधर किया गया है. जिसमें 3 महिला प्रधान आरक्षक भी शामिल हैं. एसपी विजय अग्रवाल ने आदेश जारी किया है.