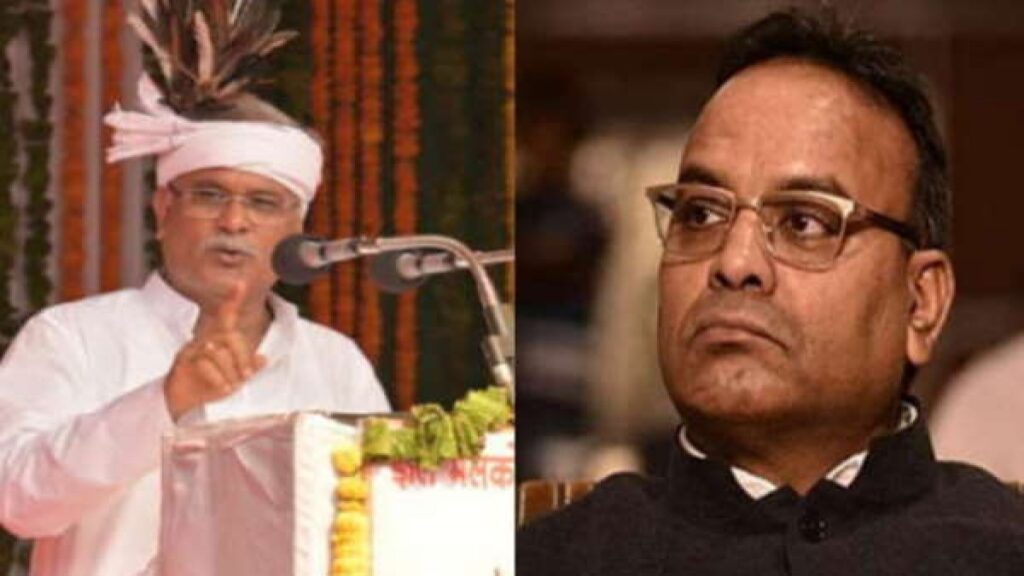

War of words – आरक्षण और वंदे भारत पर CM भूपेश के बयान पर अजय का पलटवार

मुख्यमंत्री भूपेश बघेल और पूर्व मंत्री तथा बीजेपी के मुख्य प्रवक्ता अजय चद्राकर के बीच 48 घंटे से वाकयुद्ध सा छिड़ गया है। कभी मिडिया तो कभी सोशल मिडिया में अजय राज्य सरका के कामकाज, आरक्षण और वंदे भारत ट्रेन के शुभारंभ पर आमंत्रित नहीं किये जाने को लेकर बयान जारी किया है। तो सीएम भूपेश बघेल भी बीजेपी और अजय चंद्राकर को आदिवासी आरक्षण विरोधी बताया है। सीएम ने पूर्व मंत्री पर आरोप लगते हुए कहा है कि आरक्षण का भरे सदन में अजय चंद्राकर विरोध कर चुके हैं।

वहीँ वंदे भारत एक्सप्रेस के शुभारंभ अवसर पर मुख्यमंत्री को आमंत्रित नहीं किए जाने वाले बयान में सीएम भूपेश बघेल ने कहा कि- केंद्र में जनप्रतिनिधियों का अपमन होता हैं, मैने तो चीफ सेक्रेटरी को चिट्ठी लिख दी थी कि मुझे किसी कार्यक्रम में न बुलाया जाए। भाजपा पर आरक्षण विरोधी होने का आरोप भी मुख्यमंत्री ने भाजपा को आरक्षण का विरोधी भी बताया।

उन्होंने कहा, अजय चंद्राकर का विधानसभा का बयान निकालकर देख लें। वे आरक्षण के विरोधी हैं। उन्होंने विधानसभा में कहा था, मैं पार्टी से बंधा हुआ हूं लेकिन व्यक्तिगत तौर पर मैं आरक्षण का विरोधी है। यही हाल भाजपा के हर नेता का है। वे आरक्षण के विरोधी हैं चाहे 32% आदिवासियों को देने की बात हो या 27% अन्य पिछड़ा वर्ग को हो, या फिर 13% अनुसूचित जाति का या 4% सामान्य वर्ग का। यह आरक्षण देने के लिए वे बिल्कुल तैयार नहीं हैं।

मुख्यमंत्री के बयान का भाजपा प्रवक्ता चंद्राकर ने जवाब दिया है। मुख्य प्रवक्ता अजय चंद्राकर ने वंदे भारत एक्सप्रेस के शुभारंभ पर मुख्यमंत्री भूपेश बघेल को आमंत्रित नहीं करने वाले बयान पर कहा – केंद्र सरकार छग को सभी प्रकार की सौगात दे रही है। मुख्यमंत्री ने एक बार भी किसी काम के लिए प्रधानमंत्री को धन्यवाद नहीं दिया। वे बताये की वन्दे के समर्थन में है कि वंदे भारत के।

पहले यह स्पष्ट करें, मुख्यमंत्री डबल गेम वाली राजनीति न करें। श्री चंद्राकर ने कहा-केंद्र सरकार छत्तीसगढ़ को सब दे रही हैं, पर आज तक मुख्यमंत्री ने thankuou का कोई शब्द नहीं कहा। केन्द्र के बारे में उन्हें बात करने का कोई अधिकार नहीं है। वह हमारा अधिकार है। उन्होंने कहा-मुख्यमंत्री रोज केंद्र सरकार का अपमान करते हैं। श्री चंद्राकर ने कहा-जैसा बोयेंगे वैसा काटेंगे।