छत्तीसगढ़: कलेक्टर सहित 79 अधिकारियों ने किया नेत्रदान की घोषणा…

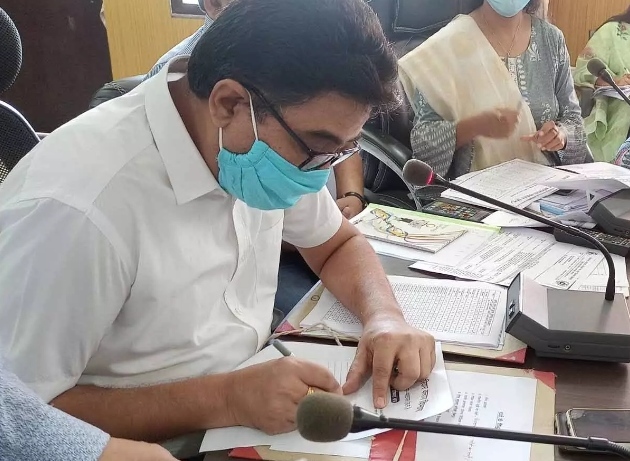

बलौदाबाजार। राष्ट्रीय नेत्रदान पखवाड़े के अंतर्गत आज कलेक्टर सुनील कुमार जैन ने नेत्रदान करनें हेतु संकल्प घोषणा पत्र भरा। उन्होंने राष्ट्रीय नेत्रदान पखवाड़े के अंतर्गत आयोजित बैठक में उक्त संकल्प पत्र भरकर जिला अंधत्व निवारण समिति को सौपा।

कलेक्टर सुनील कुमार जैन के इस पुण्य संकल्प से प्रेरित होकर बैठक में उपस्थित 79 अधिकारियों ने भी नेत्रदान करनें हेतु संकल्प घोषणा पत्र भरा। सिविल सर्जन डॉ राजेश अवस्थी ने नेत्रदान के विषय मे विस्तृत जानकारी सभी को दिया। उन्होंने बताया कि किसी व्यक्ति के मृत्यु के 6 घन्टे के भीतर आँख को दान दिया जा सकता है। इस दान दिए हुए आँख से किसी अंधेरे से भरे जीवन मे रोशनी आ सकती है।

आँख दान करना एक पुण्य काम है। हम सभी को इसका निश्चित रूप सहभागी बनाना चाहिए। उन्होंने बताया कि जिस व्यक्ति एवं उनके परिजनों को नेत्रदान करना है वह डॉ भीमराव अम्बेडकर स्मृति चिकित्सालय 91110-14444, जिला चिकित्सालय बलौदाबाजार 07727-223532 एवं डॉ राजेश अवस्थी 94255-18144 में भी सम्पर्क कर सकतें है।