AMD Stock Slides Despite Strong Revenue and Upbeat Forecast

Shares Tumble in After-Hours Trading as U.S. Export Controls on China and High Investor Expectations Overshadow Record Results

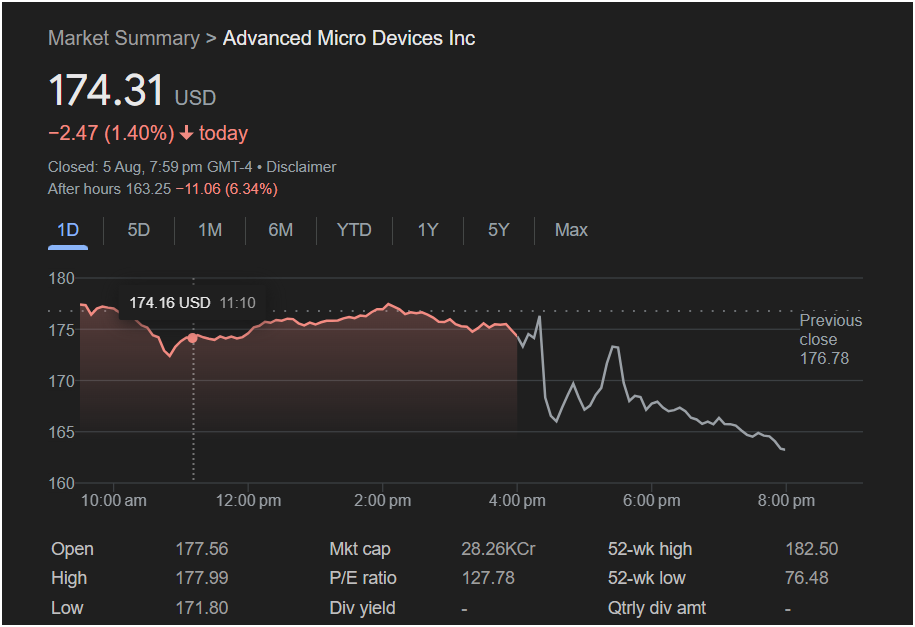

Santa Clara, CA – August 5, 2025 – Shares of Advanced Micro Devices Inc. (NASDAQ: AMD) experienced a significant downturn in after-hours trading on Tuesday, despite the company reporting record second-quarter revenue and an optimistic outlook for the third quarter. The stock closed the regular session at 174.31 USD, a decrease of 1.40%, but fell more sharply after the bell, dropping over 6% to 163.25 USD.

The sell-off occurred even as AMD announced record revenue of $7.7 billion for the second quarter, a 32% increase year-over-year that surpassed analysts’ expectations.[1][2] The company also projected strong third-quarter revenue of approximately $8.7 billion, which is also ahead of Wall Street consensus.[3][4]

The sell-off occurred even as AMD announced record revenue of $7.7 billion for the second quarter, a 32% increase year-over-year that surpassed analysts’ expectations.[1][2] The company also projected strong third-quarter revenue of approximately $8.7 billion, which is also ahead of Wall Street consensus.[3][4]

However, the strong performance was overshadowed by several factors, including the impact of U.S. government export restrictions on high-performance AI chips to China.[5] These controls led to an approximately $800 million inventory write-down and related charges for AMD’s Instinct MI308 data center GPU products, which significantly impacted the company’s gross margin.[1][2] The reported non-GAAP gross margin was 43%; excluding the charges, it would have been around 54%.[1]

“We delivered strong revenue growth in the second quarter led by record server and PC processor sales,” said Dr. Lisa Su, AMD Chair and CEO. “We are seeing robust demand across our computing and AI product portfolio and are well positioned to deliver significant growth in the second half of the year.”[1]

The company’s performance was bolstered by a 69% year-over-year increase in its Client and Gaming segment revenue, which reached $3.6 billion.[1][3] The Data Center segment also saw a 14% year-over-year revenue increase to $3.2 billion, driven by strong demand for EPYC processors.[1]

Despite the positive top-line numbers and a strong forecast, which notably excludes any potential revenue from MI308 shipments to China pending license reviews, investors reacted negatively.[3][5] The market’s reaction suggests that after a more than 45% rally in AMD’s stock price this year, investor expectations were exceptionally high.[2][6] The earnings per share of $0.48, while in line with expectations, did not provide the upside surprise some investors may have been looking for.[7][8]

During the trading day, AMD’s stock reached a high of 177.99 USD and a low of 171.80 USD. Over the past 52 weeks, the stock has traded between 76.48 USD and 182.50 USD.