RTX Stock Reversal: Key Support Tested After Failed Breakout Attempt

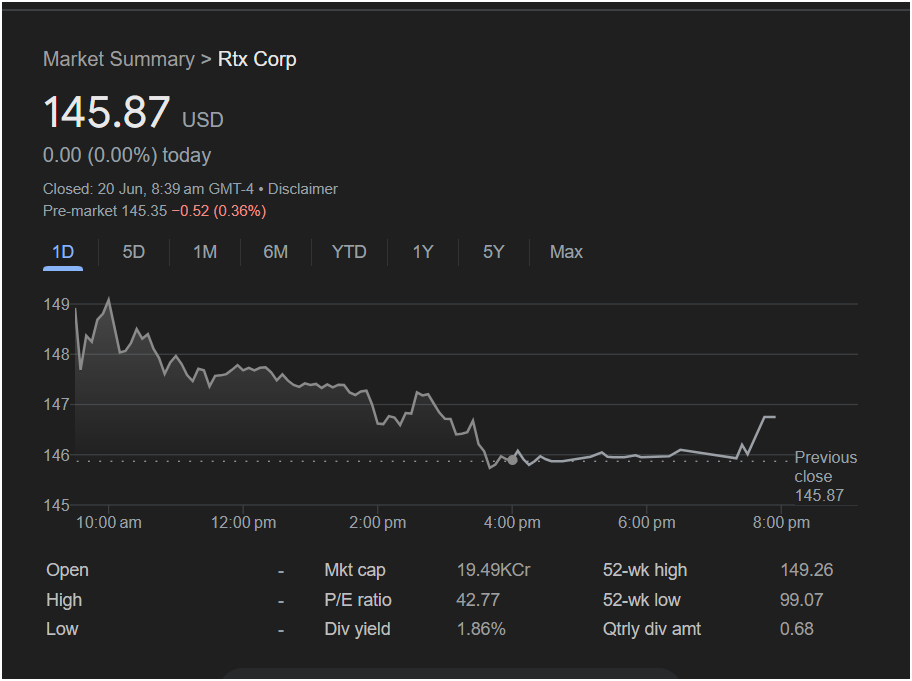

RTX Corp (RTX) stock is at a critical juncture after a volatile trading session on Thursday saw a powerful morning rally completely erased by sellers. The session’s dramatic reversal from near 52-week highs puts the focus squarely on a key support level as traders look for direction on Monday.

The Story of a Failed Rally

The market data from Thursday, June 20th, shows RTX stock closing at 145.87 USD, a perfectly flat 0.00% change. However, this static closing number masks a day of significant conflict between bulls and bears.

The trading day began with immense promise for bulls. The stock surged in the morning, climbing to a high near $149, just shy of its 52-week high of

146** late in the afternoon.

The negative sentiment appears to be carrying over, with pre-market data on Friday showing the stock down -0.52 (-0.36%) to $145.35, a level below Thursday’s lowest point.

Key Trading Metrics at a Glance

For traders assessing the health of RTX, these numbers from the session are vital:

-

Closing Price: 145.87 USD

-

Day’s Change: 0.00 (0.00%)

-

Pre-Market Price: 145.35 (-0.36%)

-

52-Week High: 149.26

-

52-Week Low: 99.07

-

Dividend Yield: 1.86%

-

P/E Ratio: 42.77

The stock’s failure to hold its gains near the 52-week high is a significant technical event.

Outlook: Is it Time to Invest in RTX?

Disclaimer: This article is an analysis of past performance and technical indicators. It is not financial advice. Investing in the stock market carries risks, and you should conduct your own research or consult a financial advisor before making any investment decisions.

The price action has created a clear “reversal” pattern, which typically favors the bears. Here’s what to watch for on Monday.

The Bearish Case (Potential for the Stock to Go Down):

The technical picture strongly suggests caution. A sharp rejection from a 52-week high is a classic sign of a potential top. The persistent selling throughout the day and the weak pre-market action reinforce this view. The most critical level is the support established in the afternoon, around $145.50 – $145.80. Since the pre-market price is already below this, any failure to reclaim this level at the open on Monday would be a very bearish signal, potentially opening the door for a deeper correction.

The Bullish Case (Potential for the Stock to Go Up):

For a bullish scenario to unfold, buyers must prove that Thursday’s reversal was a one-off event. This would require a strong showing at the market open on Monday. Bulls would need to absorb the pre-market selling pressure and quickly push the price back above the

147 would be the first sign that bulls are fighting back.

for Traders

The momentum has clearly shifted in favor of the sellers for RTX stock.

-

Key Support Zone: $145.35 – $145.80. This is the immediate battleground.

-

For Bearish Traders: The current setup is favorable. A failure to reclaim $146 at the open could be a signal to initiate or add to short positions, using the $147 level as a potential stop.

-

For Bullish Traders: Extreme caution is warranted. It would be prudent to wait for the stock to show signs of strength, such as a decisive move back above $147, before considering a long position. Buying a falling stock after such a strong reversal can be a high-risk strategy.

Monday’s opening price action relative to the $145.50 level will be the key determinant for RTX’s direction in the coming week.