KLA Corp Stock Analysis: Pre-Market Surge Signals Potential for a Bullish Trading Day

Traders are closely watching KLA Corp stock as it shows significant strength in pre-market activity, suggesting a positive start to the next trading session. Based on the latest data, key indicators point towards upward momentum, though the stock is approaching a critical price level that investors should monitor. Here is a comprehensive breakdown of what traders need to know.

Key Takeaways from the Data:

-

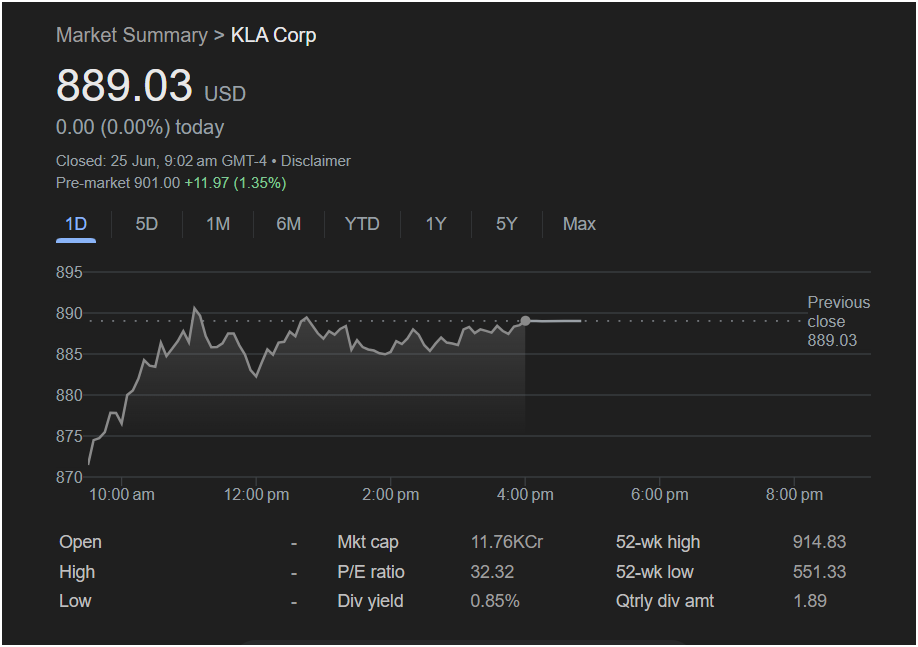

Previous Close: KLA Corp (KLAC) finished the last trading session at $889.03 USD.

-

Previous Day’s Performance: The stock closed flat, with a change of $0.00 (0.00%). However, the intraday chart reveals that the stock rallied significantly early in the day before consolidating its gains, indicating underlying strength.

-

Strong Pre-Market Indicator: The most crucial signal for today’s trading is the pre-market price. The stock is quoted at

11.97 (+1.35%). This strong buying interest before the opening bell is a powerful bullish indicator, suggesting the stock will likely open higher.

Intraday Performance and Technical Levels

A closer look at the 1-day chart from the previous session shows that KLA Corp stock opened lower (around the $872 level) before a sharp rally in the first hour of trading that pushed it above $890. For the remainder of the day, the stock traded sideways in a stable range, successfully holding onto its earlier gains and closing near the top of its daily range. This price action demonstrates resilience and a solid support base.

For traders, key price levels to watch are:

-

52-Week High: $914.83

-

52-Week Low: $551.33

With a closing price of $889.03 and a pre-market price of $901.00, KLA Corp is trading very close to its 52-week high. While this demonstrates powerful momentum, it also represents a potential resistance level. A decisive break above $914.83 could signal a further run-up, while failure to break this level might lead to a short-term pullback.

Fundamental Metrics for Context

Beyond the price chart, the following financial metrics provide a broader picture for investors:

-

Market Cap: 11.76KCr (This notation suggests a market capitalization of approximately $117.6 Billion, placing KLA Corp firmly in the large-cap category).

-

P/E Ratio: 32.32 – This valuation suggests that investors have healthy growth expectations for the company, which is common for firms in the semiconductor and technology sector.

-

Dividend Yield: 0.85% – The company provides a modest dividend, with a quarterly payout of $1.89 per share. This indicates financial health and a commitment to returning capital to shareholders.

Will the Market Go Up Today? Is It Right to Invest?

Based on the evidence in the screenshot, the outlook for KLA Corp stock at the market open is positive. The 1.35% pre-market surge is the most dominant short-term indicator, signaling strong demand that is likely to carry over into the official trading session. The stock’s ability to hold its gains during the previous day further supports this bullish thesis.

For Traders: The immediate opportunity appears to be on the long side, capitalizing on the pre-market momentum. However, caution is advised as the stock approaches its 52-week high of $914.83, which could act as a ceiling.

For Investors: The stock is demonstrating strong long-term performance, trading near its peak. The fundamentals, including a reasonable P/E ratio for its sector and a steady dividend, are solid. An investment decision would depend on an individual’s strategy, but the current momentum is undeniably positive.

Disclaimer: This article is an analysis based solely on the provided image and does not constitute financial advice. Market conditions are volatile and can change rapidly. All investors and traders should conduct their own thorough research and consult with a qualified financial advisor before making any investment decisions.