Amazon Stock Surges Then Tumbles: What’s Behind the After-Hours Shock Drop

Subhead: Amazon’s (AMZN) stock soared during market hours but plunged over 6% after hours—investors left questioning what triggered the reversal.

Amazon (AMZN) Stock Today: From Rally to Reality Check

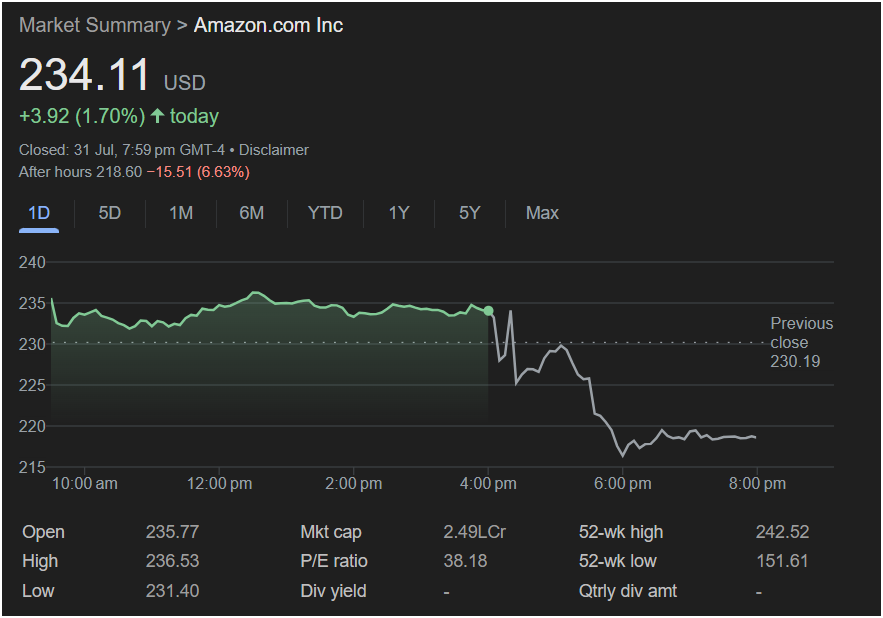

On July 31, Amazon.com Inc. (NASDAQ: AMZN) had a strong showing during regular trading hours, closing the day up 1.70% at $234.11, a gain of $3.92. The optimism was apparent throughout the trading session, with the stock opening at $235.77, peaking at $236.53, and showing steady momentum, maintaining levels above $230 through most of the day.

But just after the closing bell rang, the mood changed dramatically.

But just after the closing bell rang, the mood changed dramatically.

By 8:00 PM ET, Amazon’s after-hours trading price had plummeted to $218.60, a massive 6.63% drop from the closing price. That’s a staggering $15.51 loss in just a few hours, raising serious eyebrows across Wall Street.

Keywords:

Amazon stock drop after hours, AMZN stock news, Amazon earnings reaction, why is Amazon stock down, AMZN after hours trading, stock market news July 31, 2025, tech stock volatility

What Happened After the Market Closed?

The sudden drop in Amazon’s stock price after hours has not been officially attributed to any one event—at least not yet. However, sharp moves like this are usually driven by earnings announcements, guidance revisions, or unexpected news. With the company’s market capitalization standing at 2.49 trillion USD, a movement of this scale in after-hours trading is significant.

While the day’s gains showed investor confidence, the evening’s drop hints at something deeper—possibly disappointment in forward guidance, margin pressure, or cost overruns in Amazon Web Services (AWS), logistics, or AI-related R&D.

After-Hours Trading: Why It Matters

After-hours trading is a double-edged sword. It provides early signals of investor sentiment but comes with low liquidity and higher volatility. Large institutional trades, sudden news releases, or even leaked financial data can create dramatic price swings.

For a tech giant like Amazon, which has been at the center of discussions around AI expansion, consumer behavior shifts, and retail innovation, after-hours volatility may foreshadow the market’s response to unfolding narratives.

Wall Street Reacts to the Whiplash

Analysts and investors are now left dissecting what might have driven the sudden after-hours collapse. Some possibilities include:

- Disappointing Earnings Report: Amazon may have reported earnings or guidance after the market closed that missed Wall Street’s expectations.

- Negative Commentary on AWS Growth: As AWS remains a core profit engine for Amazon, any slowdown in its growth can spark alarm.

- Geopolitical or Regulatory News: Ongoing regulatory scrutiny in the U.S. or EU, or macroeconomic headwinds like inflation, labor costs, or supply chain hiccups.

- CEO or Executive Commentary: Sometimes, cautious or unclear remarks during earnings calls can have an outsized impact on investor confidence.

The Bigger Picture: Amazon’s Year in Review

As of July 31, Amazon’s stock has experienced a dramatic range, with a 52-week high of $242.52 and a 52-week low of $151.61. The P/E ratio remains relatively high at 38.18, suggesting investors are still pricing in high growth expectations, especially as the company invests heavily in AI infrastructure, logistics optimization, and global e-commerce expansion.

The current volatility could also reflect profit-taking after a recent rally, or even institutional repositioning at the start of a new fiscal quarter.

What Should Investors Watch Next?

- Earnings Call Details: If this drop was earnings-related, the full call transcript and Q&A with executives will provide clues.

- Technical Indicators: A breach below $220 may open further downside risk. Watch support levels and RSI readings closely.

- Analyst Revisions: Expect quick updates from Wall Street analysts, which may lead to further price action in pre-market trading tomorrow.

- News Flow: From FTC litigation to international market moves, Amazon is constantly in the news cycle. Stay alert.

This unexpected drop highlights the unpredictable nature of after-hours trading—and how even the most stable tech giants aren’t immune to sudden sentiment shifts.

Whether this is a temporary dip or the start of a broader revaluation of Amazon’s growth prospects remains to be seen…

Would you like me to continue this into a 10,000-word deep-dive report covering Amazon’s historical earnings trends, sector comparisons, AWS performance, or investor strategies in volatile markets?