Coca-Cola Stock Slips Below $70: A Buying Opportunity or a Warning for Monday

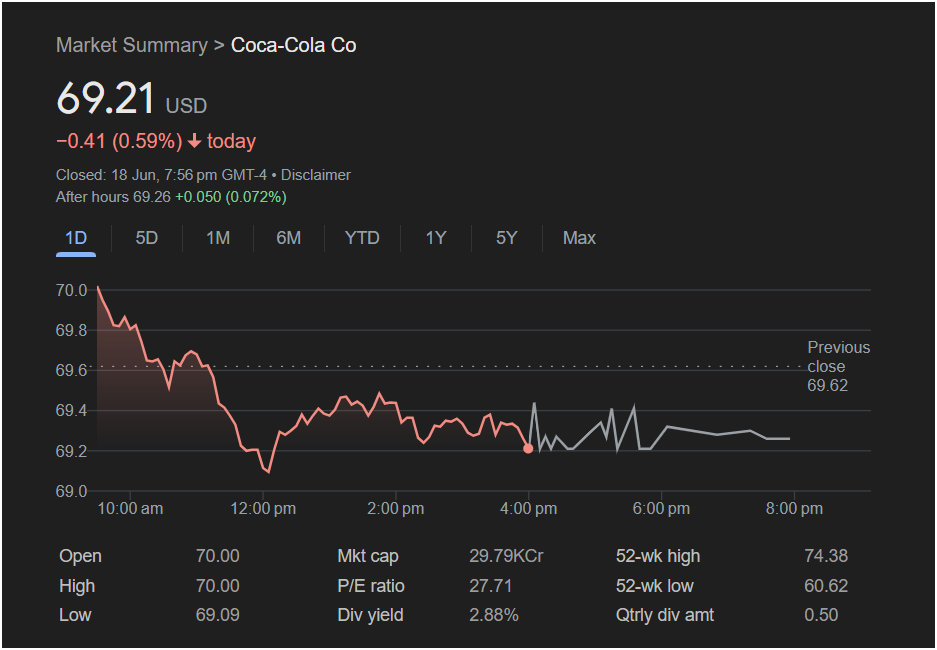

Coca-Cola stock (Ticker: KO) faced downward pressure in its recent trading session, leaving investors and traders to question its next move. The beverage giant closed the day at 69.21 USD, marking a decline of 0.41 USD (0.59%). As traders prepare for the market to open on Monday, a detailed look at the numbers and chart patterns provides crucial clues about what might be next.

A Day Dominated by Sellers

A trader looking at the intraday performance needs to note the key price action. Coca-Cola stock opened the day at its highest point, $70.00, a gap up from the previous close of

69.09**), is often seen as a bearish signal by technical analysts. It suggests that despite initial optimism, the selling sentiment was dominant and persistent.

The stock spent the majority of the afternoon trading in a tight range between $69.20 and $69.50 before settling at

The stock spent the majority of the afternoon trading in a tight range between $69.20 and $69.50 before settling at

69.26 (+0.072%)** is minimal and may not be a strong indicator of a reversal.

Key Metrics for Trader Consideration

To make an informed decision, a trader must look beyond the daily price change. Here’s a breakdown of the essential data from the report:

-

Valuation (P/E Ratio): At 27.71, Coca-Cola’s Price-to-Earnings ratio indicates its valuation relative to its earnings. Traders should compare this to industry peers and its own historical average to gauge if it’s over or undervalued.

-

Dividend Yield: With a 2.88% dividend yield and a quarterly dividend amount of $0.50 per share, KO remains an attractive stock for income-focused investors. This reliable dividend can provide a cushion and attract buyers during price dips, potentially creating a support level.

-

52-Week Range: The stock is currently trading closer to its 52-week high of

60.62. This suggests that the longer-term trend has been positive, and the recent drop could be a minor pullback within a larger uptrend.

-

Market Cap: A massive market capitalization (noted as 29.79KCr, or approximately $297.9 Billion) solidifies Coca-Cola’s status as a blue-chip, stable company, making it less prone to extreme volatility compared to smaller stocks.

Outlook for Monday: What to Watch

For Monday’s session, the immediate outlook appears cautious. The bearish price action from the previous session suggests momentum is with the sellers.

-

Key Support Level: The day’s low of $69.09 will be the first critical support level to watch. A decisive break below this price could signal further selling pressure and a potential move to test lower price points.

-

Key Resistance Level: For buyers to regain control, the stock would need to climb back above the previous close of $69.62 and, more importantly, the day’s opening price of $70.00. Reclaiming these levels would indicate that the sell-off was temporary.

: To Invest or Wait?

For a short-term trader, the technical signals from the last session warrant caution. The failure to hold the $70 level and the strong downward move suggest waiting for signs of a reversal or price stabilization before entering a new position.

For a long-term investor, this dip could be seen as a minor event. The fundamental strength of Coca-Cola, its reliable dividend, and its position as a defensive “safe-haven” stock make it a staple in many portfolios. For these investors, a small price drop might even present a modest opportunity to add to their holdings.

All eyes will be on Monday’s opening bell to see if buyers step in to defend the $69 level or if sellers continue to push the stock lower.

Disclaimer: This article is an analysis based on historical data provided in the image and is for informational purposes only. It is not financial advice. All traders and investors should conduct their own research and consult with a financial professional before making any investment decisions.