General Electric Stock Shows Resilience Amid Intraday Volatility, Nears 52-Week Highs on Aerospace Momentum

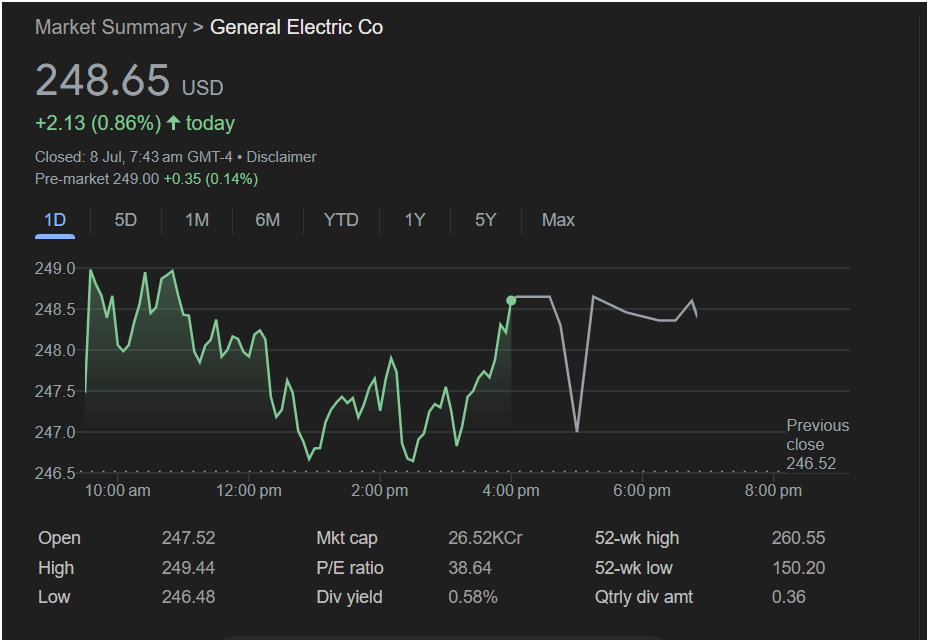

CINCINNATI / NEW YORK – July 8 – General Electric (NYSE: GE) shares endured a turbulent trading day on Monday before staging a strong comeback to close in positive territory. The stock, now a pure-play aerospace and defense giant following a historic corporate transformation, ended the session at $248.65, up $2.13 (+0.86%), after navigating wide intraday swings that reflected a fierce tug-of-war between bulls and bears.

GE opened Monday at $247.52, above its prior close of $246.52, before surging to an early high near $249. However, the initial optimism quickly gave way to a wave of selling pressure that persisted through much of the mid-session. The stock dropped to an intraday low of $246.48, marginally undercutting the previous close, as market participants tested near-term support levels.

In a remarkable turnaround, buyers stepped in decisively during the early afternoon. A sharp V-shaped rebound unfolded, culminating in a powerful rally that carried the stock to its session high of $249.44 before settling just below that peak by the closing bell. The strong finish suggested firm demand and renewed investor confidence, even as after-hours trading displayed continued volatility.

Technical Analysis: Support Holds, Resistance in Sight

The trading session offered a rich canvas for technical interpretation. Most notably, GE demonstrated a clear defense of the $246.50 level—comprising both the session low of $246.48 and the prior closing price. This confluence now marks a critical near-term support zone.

On the upside, the intraday high of $249.44 emerges as the next resistance point. A decisive close above this level would likely bring the psychologically significant $250 barrier into sharp focus. A clean breakout beyond $250 could act as a technical springboard toward GE’s 52-week high of $260.55, reinforcing the ongoing bullish momentum.

The stock’s current range, sitting near all-time highs, is a testament to the sustained uptrend it has enjoyed over the past year. This rally has catapulted the stock more than 65% from its 52-week low of $150.20, reflecting growing investor enthusiasm for the company’s renewed strategic direction.

GE Aerospace: A Leaner, More Focused Powerhouse

GE Aerospace: A Leaner, More Focused Powerhouse

Monday’s market action cannot be fully appreciated without recognizing the company’s fundamental transformation. No longer the unwieldy industrial conglomerate of decades past, GE has completed the spin-offs of GE HealthCare and GE Vernova, emerging as GE Aerospace—a highly specialized, high-margin juggernaut focused on aviation.

This streamlined identity has brought clarity and confidence to investors. With a forward-looking P/E ratio of 38.64, GE is trading at a valuation typically reserved for high-growth companies, underlining the market’s optimism in its dominant position in commercial and military jet engine manufacturing and servicing.

The company’s market capitalization, listed at ₹26,520 crore (INR), translates to a staggering ~$317 billion USD, placing it firmly among the world’s largest industrial enterprises. Its dividend yield of 0.58%, based on a quarterly payout of $0.36, reflects a preference for growth-oriented capital allocation—reinvesting in R&D and innovation to maintain technological leadership.

Tailwinds: Aviation Rebound, Global Defense Spending

GE’s bullish case rests on powerful structural tailwinds. The post-pandemic recovery in global air travel is driving massive demand for new aircraft and the servicing of existing fleets—areas where GE enjoys dominant market share through long-term partnerships with Boeing, Airbus, and global military programs.

Further, the global security environment continues to fuel elevated defense budgets, adding stability to GE’s revenue stream from military engine contracts and services.

Perhaps most significantly, GE’s services segment benefits from high-margin, recurring revenue tied to its vast installed base of jet engines. With every engine sold comes decades of aftermarket maintenance, forming a durable and growing cash flow pipeline.

Caution Flags: Valuation, Macroeconomic Risk, and Expectations

Despite the tailwinds, challenges remain. Some analysts argue that GE’s current valuation may already price in a near-perfect execution scenario. Any misstep—such as supply chain disruptions, inflationary pressures on raw materials, or a downturn in global travel—could compress margins and weigh on earnings.

Additionally, with the stock near record highs, investor expectations are sky-high. If GE fails to consistently meet or exceed earnings forecasts, the stock could be vulnerable to pullbacks or profit-taking.

Still, with pre-market indicators showing a modest uptick to $249.00 (+0.14%), momentum remains firmly intact.

Outlook: GE Positioned for Long-Term Ascent

Monday’s trading session encapsulated the essence of the “new” GE: a resilient, focused aerospace leader capable of navigating short-term market turbulence with long-term tailwinds at its back. The company’s transformation from sprawling conglomerate to specialized industrial champion is nearly complete, and Wall Street has responded with renewed confidence.

For investors, the outlook depends on the continued strength of the aerospace cycle and GE’s execution within it. While short-term volatility is inevitable, the strategic clarity and favorable industry trends suggest GE is positioned to continue climbing—potentially toward new highs.

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Data referenced is based on the provided chart and general market knowledge as of July 8, 2025. Investors are advised to conduct their own due diligence and consult a licensed financial advisor before making investment decisions.