Cisco Stock Slides Despite Strong Earnings and Bullish Analyst Sentiment

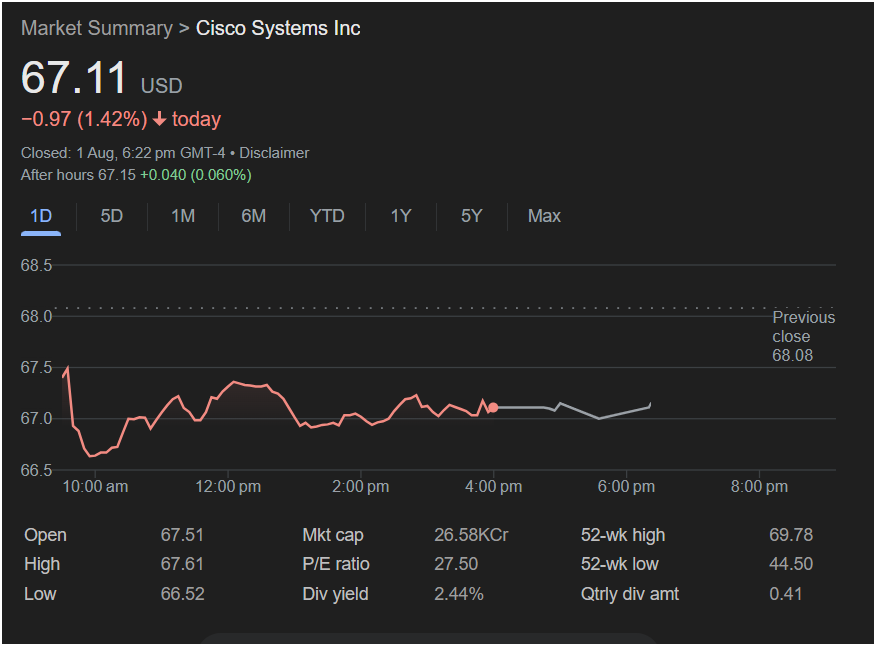

SAN JOSE, Calif. – August 3, 2025 — Cisco Systems Inc. (NASDAQ: CSCO) shares stumbled on Friday, falling 1.42% to close at $67.11, as broader market weakness and sector-specific headwinds weighed on investor sentiment. The dip came despite favorable analyst coverage and solid financial fundamentals, highlighting growing caution among investors heading into a critical earnings stretch.

Cisco stock opened at $67.51, touched an intraday high of $67.61, and slipped to a session low of $66.52 before settling at $67.11. The decline extended a recent downtrend, bringing the company’s five-day loss to 1.80%, even as most analysts maintain “Buy” or “Neutral” ratings on the stock.[1] After the closing bell, shares inched slightly higher in after-hours trading, up 0.060% to $67.15.

Macro Forces Overshadow Cisco’s Fundamentals

Macro Forces Overshadow Cisco’s Fundamentals

Friday’s losses came amid a wider market sell-off, with both the S&P 500 and the Nasdaq Composite closing in the red. Investor concerns ranged from newly proposed U.S. trade tariffs to renewed fears over global supply chains, placing pressure on technology stocks, particularly those with international exposure.[2]

For Cisco, these external factors eclipsed what many see as an increasingly compelling investment case. The company remains well-capitalized, profitable, and positioned to benefit from ongoing trends in enterprise networking, cybersecurity, and AI-powered infrastructure. Still, negative money-flow trends and concerns over short-term liquidity across tech sectors have clouded near-term visibility.[1][5]

Analysts Maintain Confidence, Raise Price Targets

Despite the price slide, Wall Street sentiment toward Cisco remains largely constructive. The stock holds a “Moderate Buy” consensus rating, based on recent analyst reports compiled from several major firms.[3][4]

Notably, Morgan Stanley recently increased its price target to $70 from $67, pointing to Cisco’s strengthening grip on enterprise customers and long-term demand for its secure networking solutions.[5] The average 12-month price target now sits around $72.07, indicating a potential upside of more than 7% from current levels.[6]

Strong Q2 Earnings Provide a Buffer

Cisco’s May 2025 quarterly earnings topped expectations, offering investors a glimpse into the company’s operational strength. The firm reported revenue of $14.15 billion, up 11.4% year-over-year, and earnings per share (EPS) of $0.96 — both above analyst consensus.[3][7]

Growth was led by recurring software revenue, next-gen firewall adoption, and robust sales of high-speed switching gear to large enterprise and government clients. Profitability metrics, including return on equity and gross margins, remained healthy, reinforcing Cisco’s reputation for delivering consistent performance, even in uncertain macroeconomic climates.[1]

Investor Focus Shifts to August Earnings

Looking ahead, all eyes are on Cisco’s next earnings report, scheduled for August 13, which could set the tone for the stock’s trajectory in the back half of the year. Analysts and investors alike will be looking for updates on:

- Guidance for FY2025 and early 2026

- Backlog strength and order pipeline

- AI-driven infrastructure initiatives

- Cloud security adoption trends

- Geographic performance, particularly in APAC and EMEA

Cisco’s commentary on IT spending cycles and global enterprise demand will be closely scrutinized for any signs of deceleration or strategic pivoting.

Valuation Still Attractive Amid Uncertainty

Despite recent volatility, Cisco trades at a forward P/E ratio well below the tech sector average, making it a favored pick for value-oriented investors seeking exposure to enterprise technology with defensive cash flow characteristics. With a market cap near $270 billion and a dividend yield above 3%, Cisco remains a top holding in many institutional portfolios, including those focused on income and capital preservation.

Tactical vs. Long-Term: A Stock at the Crossroads

While short-term sentiment may be swayed by broader market jitters and temporary dips in sector liquidity, Cisco’s long-term growth narrative remains intact. From edge computing to zero-trust security, its portfolio touches multiple high-demand verticals. As AI-driven network automation gains traction, the company may find itself uniquely positioned among legacy tech players.

Whether that’s enough to spark a sustained rally or simply stabilize the stock in the weeks ahead remains to be seen. For now, the disconnect between market behavior and analyst outlook leaves Cisco at a crossroads — one that may hinge on the upcoming earnings call.

Want a comparative breakdown of Cisco’s performance vs. peers like Arista Networks or Juniper? Or a historical chart of analyst ratings and dividend hikes over time? Let me know and I’ll tailor a side-by-side view.