Alphabet Shares Tumble in Volatile Session, Wiping Billions from Market Cap Before Staging Pre-Market Rebound

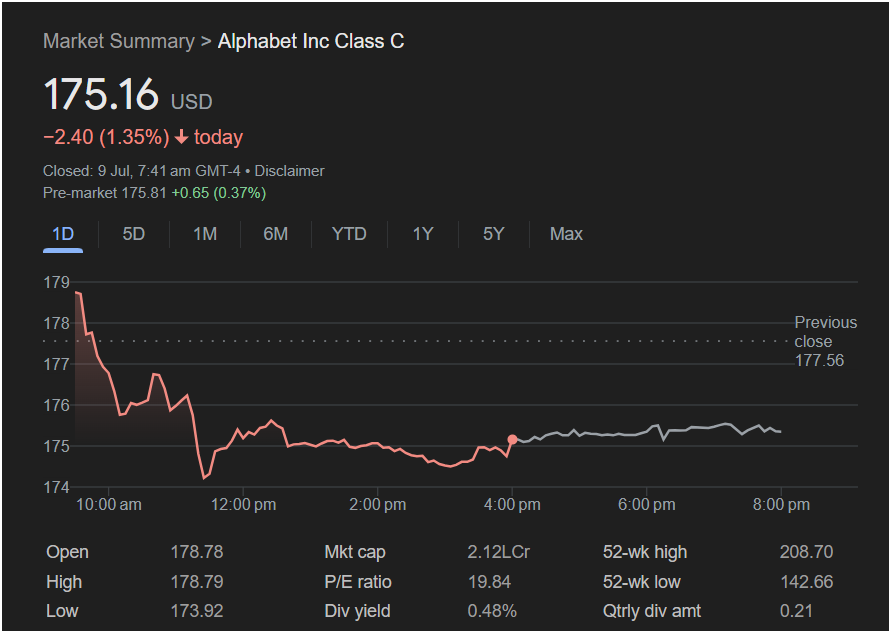

MOUNTAIN VIEW, CA – July 9 – Shares of technology behemoth Alphabet Inc. (Class C, GOOG) experienced a turbulent trading day on Tuesday, ultimately closing deep in the red as investors grappled with market-wide pressures and sector-specific anxieties. The stock finished the official trading session at

2.40, or 1.35%, from its previous close. The sharp decline reflected a day of pronounced selling pressure that saw the stock dip to a low not seen in several weeks, before finding a tentative floor and hinting at a potential recovery in early pre-market activity.

The day’s trading narrative for the Google parent company was one of immediate and sustained bearish sentiment. After a previous close of

178.78**. This opening price would almost immediately mark the day’s peak, as the stock hit an intraday high of $178.79 within moments of the opening bell. However, this early optimism quickly evaporated. A wave of selling hit the stock, pushing it into a steep descent through the morning hours.

The downward momentum was aggressive. By 10:00 am, the stock had already breached the $177 and

173.92**. This represented a stark drop of nearly $5, or about 2.7%, from its opening high, a significant swing for a mega-cap stock.

For the remainder of the afternoon, Alphabet’s stock chart depicted a battle between buyers and sellers. The price action stabilized, albeit at a depressed level, fluctuating within a tight range largely between $174 and $175.50. This period of consolidation suggested that the initial panic-selling had subsided, but a lack of significant positive catalysts prevented any meaningful recovery before the closing bell at 4:00 pm EST.

The close at

175.81** in the pre-market, a gain of $0.65 (0.37%). This modest uptick suggests that some investors may be viewing the previous day’s sharp drop as a buying opportunity, though it remains far from recouping the substantial losses.

Contextualizing the Numbers: A Deeper Dive

While a single day’s trading activity provides a snapshot, the broader financial metrics offer crucial context for Alphabet’s current standing.

Valuation and Profitability: With the day’s close, Alphabet’s market capitalization stands at an immense $2.12 trillion (indicated as 2.12LCr, likely representing $2.12 Lakh Crore in Indian numbering, which translates to the trillion-dollar scale). This figure solidifies its position as one of the most valuable companies in the world. The company’s Price-to-Earnings (P/E) ratio is listed as 19.84. This metric, which compares the company’s stock price to its earnings per share, is relatively moderate for a high-growth technology firm. A P/E under 20 can suggest to some analysts that the stock is reasonably valued, or even undervalued, compared to some of its “Magnificent Seven” peers, which often trade at much higher multiples. This could attract value-oriented investors, even amidst short-term volatility.

Shareholder Returns: A key point of interest for long-term investors is the company’s recent move to initiate a dividend. The screenshot shows a dividend yield of 0.48% and a quarterly dividend amount of $0.21 per share. While modest, the introduction of a dividend marks a significant strategic shift for Alphabet, signaling a new phase of maturity where returning capital directly to shareholders is now a priority alongside reinvesting for growth. This could broaden its appeal to income-focused investors who may have previously overlooked the stock.

Historical Performance: The day’s low of

142.66** to a high of $208.70. Tuesday’s close is approximately 16% below its 52-week peak, highlighting the pullback the stock has experienced from its recent highs. Nonetheless, it remains significantly above its yearly low, indicating that the long-term upward trend, while tested, is still largely intact.

Potential Catalysts: Searching for the “Why”

The screenshot itself does not provide a reason for the sell-off, but a 1.35% drop in a bellwether stock like Alphabet is typically driven by a combination of factors rather than a single event. Potential drivers could include:

-

Macroeconomic Headwinds: Broader market sentiment is a powerful force. Concerns over persistent inflation, future interest rate decisions by the Federal Reserve, and rising bond yields often disproportionately affect technology and other growth-oriented sectors. Higher interest rates make future profits less valuable today, putting pressure on valuations. Any negative economic data released during the day could have triggered a risk-off sentiment across the market, pulling down leaders like Alphabet with it.

-

Regulatory Scrutiny: Big Tech is in a perpetual state of navigating regulatory challenges globally. Antitrust lawsuits from the Department of Justice in the U.S., investigations by the European Commission under the Digital Markets Act (DMA), and concerns over data privacy are constant overhangs. Any news, however small, hinting at a new investigation, an unfavorable court ruling, or stricter proposed legislation can spook investors and lead to a sell-off.

-

The AI Competitive Landscape: The technology sector is currently defined by the intense “AI arms race.” Alphabet’s Gemini is in a fierce battle with competitors like OpenAI’s ChatGPT (backed by Microsoft), Meta’s Llama, and others. The market is hyper-sensitive to any perceived shifts in this landscape. A competitor’s successful product launch, a breakthrough in their AI model’s capabilities, or a new high-profile partnership could lead investors to temporarily question Alphabet’s long-term dominance, prompting a re-allocation of capital.

-

Profit-Taking and Technical Factors: After a period of strong performance, it is common for investors to engage in profit-taking, especially ahead of key events like a company’s quarterly earnings report. The stock’s failure to hold its opening high may have triggered technical sell signals for algorithmic traders, exacerbating the downward momentum.

Looking Ahead: A Test of Resilience

The pre-market uptick offers a glimmer of hope for bulls, but the road ahead will be closely watched. Investors will be looking for the stock to establish a new support level and reclaim the ground it lost. The key focus will now shift to the upcoming quarterly earnings report, which will provide the next major fundamental catalyst. Wall Street will scrutinize not only the top- and bottom-line numbers but also the performance of Google’s Cloud division, advertising revenue trends, and, most importantly, management’s commentary on its AI strategy, spending, and monetization plans.

Tuesday’s session served as a stark reminder of the inherent volatility in the stock market, even for its largest and most established players. While the 1.35% decline was significant, Alphabet’s foundational strengths—its dominant search engine, thriving cloud business, massive cash reserves, and leading position in AI research—remain formidable. The day’s price action represents a short-term sentiment shift, and its ability to rebound will be a testament to the market’s long-term faith in its innovative capacity and enduring market power.